SeedInvest

| |||||||||||||||||||||||||||

Read other articles:

Un árbol simple sin ordenar. En este diagrama, el nodo con la etiqueta 7 tiene dos hijos, el 2 y el 6, y un padre, el 2. La raíz, al inicio, no tiene padre. En ciencias de la computación y en informática, un árbol es un tipo abstracto de datos (TAD) ampliamente usado que imita la estructura jerárquica de un árbol, con un valor en la raíz y subárboles con un nodo padre, representado como un conjunto de nodos enlazados. Una estructura de datos de árbol se puede definir de forma recurs...

Dinasti Tang (唐朝) yang memerintah dari tahun 618 hingga 907 diperintah oleh kaisar-kaisar bermarga Li (李). Didirikan oleh seorang jenderal Sui bernama Li Yuan yang naik tahta sebagai Kaisar Tang Gaozu setelah berhasil mempersatukan negara yang sempat terpecah-belah pasca runtuhnya Dinasti Sui. Dinasti ini diselingi oleh masa pemerintahan seorang kaisar wanita satu-satunya dalam sejarah Tiongkok, yaitu Wu Zetian (625-705) yang menamakan dinastinya sebagai Dinasti Zhou (690-705), dalam se...

2011 video game For the game engine, see Rockstar Advanced Game Engine. 2011 video gameRageDeveloper(s)id Software[a]Publisher(s)Bethesda SoftworksDirector(s)Tim WillitsProducer(s)Hunter HynemanJason KimMatthew NelsonProgrammer(s)Robert DuffyJan Paul van WaverenWriter(s)Matthew J. CostelloComposer(s)Rod AbernethyEngineid Tech 5Platform(s)Microsoft WindowsPlayStation 3Xbox 360OS XReleaseWindows, PlayStation 3, Xbox 360NA: October 4, 2011AU: October 6, 2011EU: October 7, 2011OS XWW: Feb...

Artikel ini sebatang kara, artinya tidak ada artikel lain yang memiliki pranala balik ke halaman ini.Bantulah menambah pranala ke artikel ini dari artikel yang berhubungan atau coba peralatan pencari pranala.Tag ini diberikan pada Desember 2022. Misaki AmanoInformasi pribadiNama lengkap Misaki AmanoTanggal lahir 22 April 1985 (umur 38)Tempat lahir Prefektur Gifu, JepangTinggi 1,73 m (5 ft 8 in)Posisi bermain Penjaga gawangKarier senior*Tahun Tim Tampil (Gol)2008–2011 TEP...

American football player (1903–1991) American football player Red GrangeGrange in 1925No. 77Position:HalfbackPersonal informationBorn:(1903-06-13)June 13, 1903Forksville, Pennsylvania, U.S.Died:January 28, 1991(1991-01-28) (aged 87)Lake Wales, Florida, U.S.Height:6 ft 0 in (1.83 m)Weight:180 lb (82 kg)Career informationHigh school:Wheaton (Wheaton, Illinois)College:Illinois (1923–1925)Career history As a player: Chicago Bears (1925) New York Yankees (1926–1...

Les représentants de l'Utah sont les membres de la Chambre des représentants des États-Unis élus pour l'État de l'Utah. Délégation au 118e congrès (2023-2025) District et Nom Début du mandat Parti 1 Blake Moore 3 janvier 2021(3 ans, 2 mois et 27 jours) Républicain 2 Celeste Maloy 28 novembre 2023(4 mois et 2 jours) Républicain 3 John Curtis 13 novembre 2017(6 ans, 4 mois et 17 jours) Républicain 4 Burgess Owens 3 janvier 2021(3 ans, 2&#...

Questa voce sull'argomento calciatori algerini è solo un abbozzo. Contribuisci a migliorarla secondo le convenzioni di Wikipedia. Segui i suggerimenti del progetto di riferimento. Rafik Djebbour Nazionalità Algeria Altezza 185 cm Calcio Ruolo Attaccante Termine carriera 2018 Carriera Squadre di club1 2003-2004 Auxerre 28 (3)2004-2005 La Louvière21 (3)2005-2006 Ethnikos Asteras16 (11)2006-2007 Atromītos14 (6)2007-2008 Paniōnios38 (18)[1]2008-20...

Romanian general and engineer Constantin Hârjeu Constantin Hârjeu (December 10, 1856 – May 24, 1928) was a Romanian general and engineer. Born into a poor family in Bucharest, he attended the officers’ school there from 1874 to 1876. Hârjeu then went to the École Polytechnique in Paris and to the School of Applied Artillery at Fontainebleau, becoming among the first Romanian military engineers educated abroad. Returning home, he steadily advanced through the ranks of the ...

Indian religion Part of a series on theRavidassia Beliefs and practices Aarti Meditation Naam Japo Simran Nagar Kirtan Langar Sevā Temples Bhawan, Gurdwara Scriptures Amritbani Guru Ravidass Ji, Guru Granth Sahib Holy Places Shri Guru Ravidass Janam Asthan Sant Ravidas Ghat Founder Guru Ravidass Sants Gaddi Nashins Kabir Namdev Sadhana Sain Trilochan Guru Nanak Festivals Guru Ravidass Jayanti Symbols ਹਰਿ vte Ravidassia or the Ravidas Panth[1] is a religion based on the teaching...

2015 song by Il Volo This article is about the song. For the eponymous album, see L'amore si muove. Grande amoreSingle by Il Volofrom the album Sanremo grande amore & Grande Amore Released12 February 2015Recorded2014GenreOperatic popLength3:45 (original version)3:00 (ESC version)LabelSony Music ItalySongwriter(s)Francesco BocciaCiro EspositoProducer(s)Celso ValliMichele TorpedineIl Volo singles chronology El Triste (2013) Grande amore (2015) L'amore si muove (2015) Music videoGrande amore...

Australian racing driver Dale WoodDale Wood in 2014Nationality AustralianBorn (1983-06-09) 9 June 1983 (age 40)Melbourne, Victoria, AustraliaSupercars Championship careerCar number26Current teamGrove Racing(Endurance race co-driver)Championships0Races158Wins0Podiums1Pole positions02020 position42nd (108 pts) Dale Ian Wood (born 9 June 1983) is an Australian racing driver who currently co-drives for Brad Jones Racing's No. 8 Holden ZB Commodore in the Pirtek Enduro Cup. He currently ...

Premier League Malti 1965-1966 Competizione Premier League Malti Sport Calcio Edizione 51ª Organizzatore MFA Date dal 16 ottobre 1965al 23 febbraio 1966 Luogo Malta Partecipanti 6 Formula 1 girone all'italiana Risultati Vincitore Sliema Wanderers(18º titolo) Retrocessioni Birkirkara Statistiche Miglior marcatore John Bonnet Ronald Cocks (6)[1] Incontri disputati 60 Gol segnati 75 (1,25 per incontro) Cronologia della competizione 1964-65 1966-67 M...

Canadian politician This article needs to be updated. Please help update this article to reflect recent events or newly available information. (September 2019) Chris BradshawInterim Leader of the Green Party of CanadaIn office2001–2003Preceded byJoan RussowSucceeded byJim Harris Personal detailsBornChristopher John Bradshaw(1944-05-20)May 20, 1944Vancouver, British Columbia, CanadaDiedNovember 3, 2018(2018-11-03) (aged 74)Ottawa, Ontario, CanadaPolitical partyGreenAlma materOberlin Col...

إمبراطور اليابان الإمبراطور كوريه (باليابانية: 孝霊天皇) إمبراطور اليابان فترة الحكمأسطوري معلومات شخصية تاريخ الميلاد أسطوري تاريخ الوفاة أسطوري مكان الدفن أوجي مواطنة اليابان الأولاد الإمبراطور كوغين الأب الإمبراطور كوان عائلة البيت الإمبراطوري �...

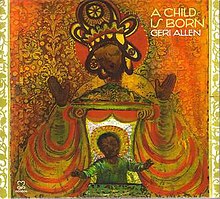

For 1995 album, see Choir of Trinity College, Cambridge. 2011 studio album by Geri AllenA Child Is BornStudio album by Geri AllenReleasedOctober 11, 2011RecordedJanuary 14–15 and April 27–28, 2011StudioUnion Country Performing Arts Center, Rahway, NJ and Klavierhaus, NYCGenreJazz, ChristmasLength50:31LabelMotéma MTM-69ProducerGeri Allen & Kunle MwangaGeri Allen chronology Geri Allen & Timeline Live(2009) A Child Is Born(2011) Grand River Crossings(2013) A Child Is Born i...

Patung Lu Yu di Xi'an Lu Yu (Hanzi sederhana: 陆羽; Hanzi tradisional: 陸羽; Pinyin: Lù Yǔ; 733–804) adalah seorang master dan penulis teh Tiongkok. Dia dihormati sebagai Legenda Teh karena kontribusinya pada budaya teh Tiongkok. Dia terkenal karena bukunya yang monumental The Classic of Tea, karya definitif pertama tentang mengolah, membuat dan minum teh. Lu lahir pada 733 di Tianmen, Hubei. Selama enam tahun, ia tinggal di gunung Huomen belajar di bawah bimbingan Zou Fuz...

Pour les articles homonymes, voir Sander. Jil SanderBiographieNaissance 27 novembre 1943 (80 ans)HedwigenkoogNom de naissance Heidemarie Jiline SanderNationalités allemandeautrichienneDomicile HambourgFormation Université de Californie à Los AngelesActivités Modéliste, écrivaine, journalistePériode d'activité 1966-2015Autres informationsSite web www.jilsander.comDistinctions Prix du traducteur de la langue (1997)Chevalière de l'ordre du Mérite de la République fédérale d'Al...

Professional Fighters League MMA event in 2024 PFL Europe 3The poster for PFL Europe 3InformationPromotionProfessional Fighters LeagueDateSeptember 28, 2024 (2024-September-28)VenueOVO HydroCityGlasgow, ScotlandEvent chronology PFL 9 PFL Europe 3 PFL Super Fights: Battle of the Giants Main article: 2024 in Professional Fighters League PFL Europe 3 is an upcoming mixed martial arts event produced by the Professional Fighters League that will take place on September 28, 2024, at ...

Questa voce sull'argomento calciatori jugoslavi è solo un abbozzo. Contribuisci a migliorarla secondo le convenzioni di Wikipedia. Segui i suggerimenti del progetto di riferimento. Zoran StojadinovićNazionalità Jugoslavia Calcio RuoloAttaccante Termine carriera1993 CarrieraSquadre di club1 1979-1980 OFK Belgrado5 (0)1980-1981 Rijeka4 (0)1981-1983 Galenika Zemun54 (4)1984-1986 OFK Belgrado62 (17)1986-1987 Admira/Wacker31 (14)1987-1988 Rapid Vienna41 ...

Star in the constellation Sagittarius WR 102ka The Peony Nebula, as discovered by NASA's Spitzer Space Telescope. This three-color infrared composite shows 3.6-micrometre light in blue, 8-micrometre light in green, and 24-micrometre light in red. The Peony nebula is the reddish cloud of dust in and around the white circle, surrounding the Peony nebular star. Observation dataEpoch J2000. Equinox J2000. Constellation Sagittarius Right ascension 17h 46m 18.12s&...