Flight-to-quality

|

Read other articles:

Pemandangan udara Lapangan Staraya (bahasa Rusia: Старая площадь Staraya Ploshchad’), artinya Lapangan Lama, menghubungkan Jalan Ilyinka dengan Lapangan Gerbang Varvarka di tengah wilayah Kitai-gorod, Moskwa, Rusia. Lapangan tersebut bukanlah lapangan dalam arti yang sebenarnya, namun sebuah jalan yang biasanya ditutup untuk mengatur lalu lintas kota. Referensi History prior to 1947: Russian: П.В.Сытин, Из истории московских улиц, М, 1948, pp....

Xolo MaridueñaMaridueña, 2021LahirRamario Xolo Ramirez9 Juni 2001 (umur 22)Los Angeles, California, A.S.PekerjaanAktorTahun aktif2012–sekarangDikenal atasCobra KaiBlue BeetleTinggi183 cm (6 ft 0 in) Romário Xolo Maridueña (bahasa Spanyol: [roˈmaɾjo ˈʃolo maɾiˈðweɲa]; lahir 9 Juni 2001) adalah seorang pemeran laki-laki asal Amerika Serikat. Dia terkenal karena perannya sebagai Miguel Diaz dalam serial Netflix, Cobra Kai, dan sebagai Victor Graham dal...

Rheintalbahn DB 4000 Mannheim – Bazel Totale lengte270,7 kmSpoorwijdte(normaalspoor) 1435 mmAangelegd doorBadischen StaatseisenbahnenGeopend1840 / 1863Huidige statusin gebruikGeëlektrificeerdjaAantal sporen2Baanvaksnelheid140 / 160 200 / 250 (HSL) km/uBeveiliging of treinbeïnvloedingPZBTreindienst doorDeutsche Bahn, AVG Traject Legenda Pfälzische Ludwigsbahn traject RHB van Bad Dürckheim RHB traject van Mainz van Ludwigshafen Kurt Schumacher-Brücke (grens Ba / Pf) Konrad-Adenauer-Brüc...

Gaya atau nada penulisan artikel ini tidak mengikuti gaya dan nada penulisan ensiklopedis yang diberlakukan di Wikipedia. Bantulah memperbaikinya berdasarkan panduan penulisan artikel. (Pelajari cara dan kapan saatnya untuk menghapus pesan templat ini) Wadah pengomposan limbah dapur dan kebun Sampah sayur mayur di sebuah pasar di India Sampah organik adalah barang yang sudah tidak terpakai dan dibuang oleh pemilik atau pemakai sebelumnya. Sampah organik masih bisa dipakai jika dikelola dengan...

Ця стаття висвітлює поточне спортивне змагання. Інформація може часто змінюватися з розвитком подій. Якщо, на ваш погляд, інформація у статті застаріла, будь ласка, внесіть необхідні зміни. Перша ліга 2023–2024Сезон 2023—2024Зіграно матчів 180Забито голів 451 (2.51 за гру)Найбіль�...

أناستاسيفسكايا علم شعار الإحداثيات 45°13′03″N 37°53′28″E / 45.2175°N 37.891111111111°E / 45.2175; 37.891111111111 تاريخ التأسيس 1865 تقسيم إداري البلد روسيا[2] الإمبراطورية الروسية الاتحاد السوفيتي[1] خصائص جغرافية ارتفاع 3 متر، و2 متر معلومات أخرى 353590–353591...

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages) This article may rely excessively on sources too closely associated with the subject, potentially preventing the article from being verifiable and neutral. Please help improve it by replacing them with more appropriate citations to reliable, independent, third-party sources. (March 2016) (Learn how and when to remove this template message) T...

Sebuag gereja Rastafari, Liberty Bell Temple II, in California Agama-agama berbeda memiliki pendirian yang beragam terhadap pemakaian ganja, baik dulu maupun sekarang. Pada zaman kuno, beberapa agama memakai ganja sebagai enteogen, terutama di anak benua India dimana tradisi tersebut masih berlanjut pada basis yang lebih terbatas. Bahá'í Dalam Kepercayaan Bahá'í, pemakaian alkohol dan obat-obatan memabukkan, yang bertentangan dengan resep obat, dilarang.[1] Buddha Dalam agama Budd...

エディタ・グルベローヴァ エディタ・グルベローヴァ基本情報出生名 Edita Gruberová生誕 1946年12月23日出身地 チェコスロバキア・ブラチスラヴァ死没 (2021-10-18) 2021年10月18日(74歳没) スイス・チューリッヒジャンル オペラ職業 歌手活動期間 1968年 - 2021年 ポータル クラシック音楽 エディタ・グルベローヴァ(Edita Gruberová, エディタ・グルベロヴァー, 1946年12月23日 - 2...

Political party in New Zealand Attica Project LeaderMike IlesMichael KayFounded27 July 2020 (2020-07-27)Split fromNew Zealand Outdoors PartyIdeologySingle-issue politicsAnti-neoliberalismColours Mint Green WhiteHouse of Representatives0 / 120Websiteattica.nzPolitics of New ZealandPolitical partiesElections The Attica Project was an unregistered political party in New Zealand. The party was founded by Mike Iles and Michael Kay, who left the New Zealand Outdoors ...

Piotr i PawełTypeJoint-stock companyIndustryRetailFounded1990; 33 years ago (1990)FoundersPiotr Woś, Paweł Woś, Eleonora WośDefunctEnd of 2019HeadquartersPoznań, PolandNumber of locationsLess than 70 (2019)Area servedPolandKey peopleMaciej StoińskiRevenuezl 2.123 billionNet incomezl 514 million (2016)[1]Number of employees4000 (2010)Websitewww.piotripawel.pl Piotr i Paweł was a retail chain of delicatessen and supermarket stores.[2]...

Graph of the frequency response of a control system This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Bode plot – news · newspapers · books · scholar · JSTOR (December 2011) (Learn how and when to remove this template message) Figure 1A: High-pass filter (1st-order, one-pole) Bode magnitude plot (top) and Bode...

Artikel ini memberikan informasi dasar tentang topik kesehatan. Informasi dalam artikel ini hanya boleh digunakan hanya untuk penjelasan ilmiah, bukan untuk diagnosis diri dan tidak dapat menggantikan diagnosis medis. Perhatian: Informasi dalam artikel ini bukanlah resep atau nasihat medis. Wikipedia tidak memberikan konsultasi medis. Jika Anda perlu bantuan atau hendak berobat, berkonsultasilah dengan tenaga kesehatan profesional. MalariaSebuah Plasmodium dari air ludah nyamuk betina bergera...

Історія наукиЕколого-ботанічний експеримент Чарлза Дарвіна у Воберн-Еббі Хронологія Давні часи Античність Давня Греція Середньовіччя Ісламське Середньовіччя Відродження Романтизм НТР Культури Африканська Візантійська Індійська Ісламська Китайська Середньовічна У�...

الدوري الإنجليزي لكرة القدم 1920–21 تفاصيل الموسم دوري كرة القدم الإنجليزية النسخة 29 البلد المملكة المتحدة البطل نادي بيرنلي الدوري الإنجليزي لكرة القدم 1919–20 الدوري الإنجليزي لكرة القدم 1921–22 تعديل مصدري - تعديل الدوري الإنجليزي لكرة القدم 1920–21 (بال...

Vernon DukeInformasi latar belakangNama lahirVladimir DukelskyLahir(1903-10-10)10 Oktober 1903Minsk Governorate, Russian EmpireMeninggal16 Januari 1969(1969-01-16) (umur 65)Santa Monica, California, United StatesGenreBroadway musicals, ClassicalPekerjaanSongwriter, composer Vernon Duke (10 Oktober 1903 – 16 Januari 1969) adalah komponis Amerika Serikat. Pengawasan otoritas Umum Integrated Authority File (Jerman) ISNI 1 2 VIAF 1 WorldCat Perpustakaan nasional Spanyol Pranc...

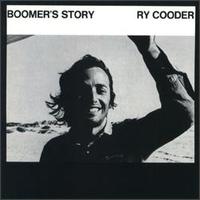

1972 studio album by Ry CooderBoomer's StoryStudio album by Ry CooderReleasedNovember 1972StudioAmigo Studios, North Hollywood; Ardent Studios, Memphis; Muscle Shoals Sound Studios, Muscle Shoals; Quadrafonic Sound Studios, NashvilleGenreRoots rock, blues, folk, AmericanaLength39:07LabelRepriseProducerJim Dickinson, Lenny WaronkerRy Cooder chronology Into the Purple Valley(1972) Boomer's Story(1972) Paradise and Lunch(1974) Professional ratingsReview scoresSourceRatingAllmusic linkChr...

Herzliebster JesuKidung semangatJohann Heermann, sang penyairBahasa InggrisYesus, Tuhanku, Apakah DosakuGenreKidungDitulis1630 (1630)Teksby Johann HeermannBahasaGermanMeter11.11.11.5Melodiby Johann CrügerDipublikasikan1630 (1630) Yesus, Tuhanku, Apakah Dosaku atau Herzliebster Jesu (sering diterjemahkan ke dalam bahasa Inggris menjadi Ah, Holy Jesus, terkadang menjadi O Dearest Jesus) adalah sebuah kidung Jerman untuk Masa Sengsara, yang ditulis pada 1630 oleh Johann Heermann, dala...

Amphitheater in Georgia, USA This article is about the venue in Alpharetta, Georgia. For similarly named venues elsewhere, see Verizon Wireless Amphitheatre. Ameris Bank AmphitheatreFormer namesVerizon Wireless Amphitheatre (2008-17)Verizon Amphitheatre (2017-19)Address2200 Encore PkwyAlpharetta, GA 30009-4837LocationMetro AtlantaOperatorLive NationCapacity12,000OpenedMay 10, 2008WebsiteVenue Website Jackie Evancho in concert at the amphitheatre in June 2012 The Ameris Bank Amphitheatre (form...

Historic building in San Francisco California HallLocation625 Polk Street, San Francisco, California, U.S.Coordinates37°46′57″N 122°25′09″W / 37.782455°N 122.419220°W / 37.782455; -122.419220Built forGerman AssociationArchitectFrederick Herman Meyer[1]Architectural style(s)German Baroque[1] San Francisco Designated LandmarkDesignatedOctober 7, 1984[2]Reference no.174 Location of California Hall in San Francisco CountyShow map of...