X-inefficiency

|

Read other articles:

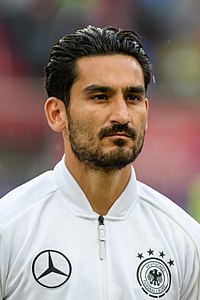

İlkay Gündoğan Gündoğan membela Jerman pada tahun 2018Informasi pribadiNama lengkap İlkay Gündoğan[1]Tanggal lahir 24 Oktober 1990 (umur 33)[2]Tempat lahir Gelsenkirchen, JermanTinggi 1,80 m[3]Posisi bermain GelandangInformasi klubKlub saat ini FC BarcelonaNomor 14Karier junior1993–1998 SV Gelsenkirchen-Hessler 061998–1999 Schalke 041999–2004 SV Gelsenkirchen-Hessler 062004–2005 SSV Buer2005–2008 VfL BochumKarier senior*Tahun Tim Tampil (Gol)200...

Artikel ini tidak memiliki referensi atau sumber tepercaya sehingga isinya tidak bisa dipastikan. Tolong bantu perbaiki artikel ini dengan menambahkan referensi yang layak. Tulisan tanpa sumber dapat dipertanyakan dan dihapus sewaktu-waktu.Cari sumber: Emak Ingin Naik Haji – berita · surat kabar · buku · cendekiawan · JSTOR Emak Ingin Naik HajiBerkas:Emak-ingin-naik-haji1.jpgSutradaraAditya GumayProduserPutut WidjanarkoAdenin AdlanJenny RachmanDitulis ...

Data Encryption StandardFungsi Feistel (fungsi F) dalam DESInformasi umumPendesainIBMPertama kali dipublikasikan1975 (distandarkan pada Januari 1977)Turunan dariLuciferPenerusTriple DES, G-DES, DES-X, LOKI89, ICEDetail penyandianUkuran kunci56 bit (+8 bit paritas)Ukuran blok64 bitStrukturJaringan Feistel berimbangRonde16Analisis kriptografi publik terbaikDES telah dianggap tidak aman sejak awal karena mudah dipecahkan oleh serangan brutal.[1] Serangan tersebut telah didemokan secara p...

Si ce bandeau n'est plus pertinent, retirez-le. Cliquez ici pour en savoir plus. Certaines informations figurant dans cet article ou cette section devraient être mieux reliées aux sources mentionnées dans les sections « Bibliographie », « Sources » ou « Liens externes » (juillet 2021). Vous pouvez améliorer la vérifiabilité en associant ces informations à des références à l'aide d'appels de notes. Pour les articles homonymes, voir Symbole (homonym...

Person who participates or advocates a revolution Revolutionist redirects here. For the Hemingway short story, see The Revolutionist. Part of a series onPolitical revolution By class Bourgeois Communist Counter-revolutionary Democratic Proletarian By other characteristic Colour From above Nonviolent Passive Permanent Social Wave Methods Boycott Civil disobedience Civil disorder Civil war Class conflict Coup d'état Demonstration Guerrilla warfare Insurgency Mutiny Nonviolent resistance Protes...

FC Aarau 1902Calcio Segni distintivi Uniformi di gara Casa Trasferta Colori sociali Bianco, nero, rosso Simboli Aquila Dati societari Città Aarau Nazione Svizzera Confederazione UEFA Federazione ASF/SFV Campionato Challenge League Fondazione 1902 Presidente Alfred Schmid Allenatore Alexander Frei Stadio Stadion Brügglifeld(9 249 posti) Sito web www.fcaarau.ch Palmarès Campionati svizzeri 3 Titoli nazionali 1 Campionato di Challenge League Trofei nazionali 1 Coppa Svizzera1 Copp...

American basketball player (1979–2018) For the NBA basketball player and executive who attended Pittsburgh, see Billy Knight. Billy KnightPersonal informationBorn(1979-01-20)January 20, 1979Los Angeles, California, U.S.DiedJuly 8, 2018(2018-07-08) (aged 39)Phoenix, Arizona, U.S.Listed height6 ft 6 in (1.98 m)Listed weight209 lb (95 kg)Career informationHigh schoolWestchester (Los Angeles, California)CollegeUCLA (1997–2002)NBA draft2002: undraftedPlaying car...

Span Air IATA ICAO Callsign — — — Founded29 November 1985[1][2]Commenced operations1995[3]AOC ##06/1995[4]Operating bases Indira Gandhi International Airport (Delhi)[5] Fleet size4Key peopleNakul Nath (Director)[2]Websitehttp://spanair.in/index.html Span Air is an Indian charter airline based in New Delhi.[4][1][6] History The airline started operations in 1995 and currently[when?] operates to domestic...

American actor (1918–2002) This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Kam Fong Chun – news · newspapers · books · scholar · JSTOR (July 2023) (Learn how and when to remove this message) Kam Fong ChunBornKam Tong Chun(1918-05-27)May 27, 1918Kalihi, Territory of Hawaii, U.S.DiedOctober 18, 2002(2002-10-...

Incendiary weapon used by the Eastern Roman (Byzantine) Empire This article is about the weapon. For wildfires etc., see Greek fires. For the band, see Greek Fire (band). Στόλος Ρωμαίων πυρπολῶν τὸν τῶν ἐναντίων στόλον, The Roman fleet burn the opposite fleet down – A Eastern Roman Empire / Byzantine war ship using their secret weapon Greek Fire against a ship belonging to the rebel Thomas the Slav, AD 821. (12th century illustration from the Mad...

British linguist (1920–2017) This article includes a list of references, related reading, or external links, but its sources remain unclear because it lacks inline citations. Please help improve this article by introducing more precise citations. (December 2017) (Learn how and when to remove this message) The Right HonourableThe Lord QuirkCBE FBALord Quirk in 2016Member of the House of LordsLord TemporalIn office12 July 1994 – 20 December 2017Vice-Chancellor of University of ...

Small nucleolar RNA Me28S-Gm3113Predicted secondary structure and sequence conservation of snoMe28S-Gm3113IdentifiersSymbolsnoMe28S-Gm3113RfamRF00531Other dataRNA typeGene; snRNA; snoRNA; CD-boxDomain(s)EukaryotaGOGO:0006396 GO:0005730SOSO:0000593PDB structuresPDBe In molecular biology, Small nucleolar RNA Me28S-Gm3113 is a non-coding RNA (ncRNA) molecule which functions in the modification of other small nuclear RNAs (snRNAs). This type of modifying RNA is usually located in the nucleolus of...

Sangmu Gymnasium is an indoor sporting arena located in Seongnam, South Korea. The capacity of the arena is 5,000 people and was built in 1986 to host wrestling events at the 1988 Summer Olympics. References 1988 Summer Olympics official report. Volume 1. Part 1. p. 192. 37°25′52″N 127°08′24″E / 37.431220°N 127.140013°E / 37.431220; 127.140013 vte Venues of the 1988 Summer Olympics (Seoul)Seoul Sports Complex Jamsil Baseball Stadium Jamsil Gymnasium Ja...

Shaving of head hair as a sign of religious devotion Roman tonsure (Catholicism) Tonsure (/ˈtɒnʃər/) is the practice of cutting or shaving some or all of the hair on the scalp as a sign of religious devotion or humility. The term originates from the Latin word tonsura (meaning clipping or shearing[1]) and referred to a specific practice in medieval Catholicism, abandoned by papal order in 1972.[citation needed] Tonsure can also refer to the secular practice of shaving all ...

American actor (1938–2008) For the historical linguist, see Paul K. Benedict. Paul BenedictPaul Benedict as Harry Bentley, 1975BornPaul Bernard Benedict(1938-09-17)September 17, 1938DiedDecember 1, 2008(2008-12-01) (aged 70)Martha's Vineyard, Massachusetts, U.S.Alma materSuffolk UniversityOccupationActorYears active1965–2008Known forThe JeffersonsSesame Street Paul Bernard Benedict (September 17, 1938 – December 1, 2008)[1] was an American actor who made nume...

مجلس التجارة الإلكترونيةالشعارمعلومات عامةالتأسيس يوليو 2018المقر الرئيسي السعوديةالمنظومة الاقتصاديةمناطق الخدمة السعوديةتعديل - تعديل مصدري - تعديل ويكي بيانات مجلس التجارة الإلكترونية هو مجلس حكومي سعودي، تأسس في يوليو 2018، بقرار من مجلس الوزراء بناء على توصية مجل�...

Memoire contre la legitimite des naissances pretendues tardives, 1764 Antoine Louis (Metz, 13 Februari 1723 - Paris, 20 Mei 1792) ialah seorang dokter bedah dan fisiolog Prancis. Ia bekerja di sejumlah rumah sakit di Paris sepanjang kariernya, termasuk Salpêtrière dan Hôpital de la Charité. Awalnya dididik sebagai dokter bedah militer, Louis menjadi profesor fisiologi pada tahun 1750. Pada tahun 1764, ia diangkat ke Académie Royale de Chirurgie. Ia menerbitkan sejumlah artikel tentang pe...

Untuk fisikawan Austria-AS yang dikenal akan spin, lihat Wolfgang Pauli. Untuk pemain sepak bola Jerman, lihat Wolfgang Paul (pemain sepak bola). Untuk informatikawan dan penerima Penghargaan Gottfried Wilhelm Leibniz, lihat Wolfgang Jakob Paul. Wolfgang PaulLahir(1913-08-10)10 Agustus 1913Lorenzkirch, Saxony, GermanyMeninggal7 Desember 1993(1993-12-07) (umur 80)Bonn, North Rhine-Westphalia, GermanyKebangsaanGermanyAlmamaterTechnical University of Munich Technical University of Berlin Un...

この項目では、平成元年度に施行された日本の法律(昭和63年法律第108号)と、当該法律に基づき、課し、又は徴する普通租税について説明しています。 かつて地方税法(昭和25年法律第226号)の上に存在した「附加価値税」という名称の普通税目については、昭和28年度改正において廃止されました。詳細は附加価値税をご覧ください。 この記事は特に記述がない限り�...

彩禾苑Choi Wo Court彩禾苑(2020年6月)概要類型居者有其屋計劃地點香港沙田區地址火炭禾上墩街18號托建方 香港房屋委員會入伙年份2021年技术细节座数1住宅套数806 兒童遊樂場 園林 大廈地面設閒座區 露天停車場 彩禾苑(英語:Choi Wo Court)是香港房屋委員會在沙田區的居者有其屋屋苑之一,項目編號為ST50[1],位於新界沙田火炭禾上墩街,鄰近火炭工業區,以及新建的...