Environmental pricing reform

|

Read other articles:

الهيئة العامة للتأمين الصحي الشامل الهيئة العامة للتأمين الصحي الشامل (مصر)الشعار البلد مصر المقر الرئيسي العاصمة الإدارية، محافظة القاهرة تاريخ التأسيس 2018 (منذ 6 سنوات) المالك رئاسة مجلس الوزراء النوع هيئة حكومية منطقة الخدمة مصر اللغات الرسمية العربية الرئيس محمد م�...

BBC Arabic TelevisionJenisTelevisi satelit & Televisi kabelNegaraBritania Raya (untuk konsumsi luar negeri)KetersediaanMancanegaraTanggal peluncuran2008Kantor pusatLondonPemilikBBCSitus webwww.bbcarabic.com (Arabic) BBC Arabic Television (bahasa Arab: بي بي سي عربي)adalah stasiun televisi Internasional BBC yang berbahasa arab. BBC Arabic Television pertama kali mengudara sejak 1994 namun siarannya berakhir bulan April 1996 karena bermasalah dengan pemerintah Arab Saudi. Pada 11 ...

Intersex activist Morgan CarpenterBorn1966NationalityAustralianKnown forBioethicist, intersex flag, co-executive director of Intersex Human Rights AustraliaWebsitemorgancarpenter.com Morgan Carpenter is a bioethicist, intersex activist and researcher.[1] In 2013, he created an intersex flag,[2] and became president of Intersex Human Rights Australia (formerly OII Australia).[3] He is now a co-executive director.[4] In 2015, he cofounded a project to mark I...

SB Creative Corp.Nama asliSBクリエイティブ株式会社Nama latinEsubī Kurieitibu Kabushiki gaishaJenisKabushiki gaishaIndustriBuku, novel ringanDidirikanMaret 24, 1999; 21 tahun laluKantorpusatTokyo, JepangTokohkunciKosei TsuchihashiIndukSoftBankSitus webwww.softbankcr.co.jp SB Creative Corp. (Jepang: SBクリエイティブ株式会社,code: ja is deprecated , Hepburn: Esubī Kurieitibu Kabushiki gaisha) adalah sebuah perusahaan penerbitan Jepang dan anak perusahaan dari perusahaan t...

Pour les articles homonymes, voir Billotte. Pierre Billotte Fonctions Député français 11 juillet 1968 – 2 avril 1978(9 ans, 8 mois et 22 jours) Élection 23 juin 1968 Réélection 4 mars 1973 Circonscription 5e du Val-de-Marne Législature IVe et Ve (Cinquième République) Groupe politique UDR (1968-1976)RPR (1976-1978) Prédécesseur Gilbert Noël Successeur Jean-Louis Beaumont 3 avril 1967 – 7 mai 1967(1 mois et 4 jours) Élection 25 novembre 1962 Législat...

1947 Soviet bomber aircraft prototype For the 1970s airborne command post aircraft of the same designation, see Ilyushin Il-18 § Variants. Il-22 Ilyushin Il-22 in front view Role BomberType of aircraft National origin Soviet Union Manufacturer Ilyushin First flight 22 July 1947 Status Prototype Number built 1 The Ilyushin Il-22, USAF/DOD designation Type 10,[1] was the first Soviet jet-engined bomber to fly. It used four Lyulka TR-1 turbojets carried on short horizontal pylons a...

Hold Onto Our Love Chanson de James Fox au Concours Eurovision de la chanson 2004 Sortie 19 avril 2004 Enregistré 2003 Durée 3:00 Langue Anglais Genre Pop Auteur Gary Miller, Tim Woodcock Compositeur Gary Miller, Tim Woodcock Producteur Gary Miller Label Brian Rawling Productions Chansons représentant le Royaume-Uni au Concours Eurovision de la chanson Cry Baby(2003) Touch My Fire(2005)modifier Hold Onto Our Love est la chanson représentant le Royaume-Uni au Concours Eurovision de l...

Fictional deity in the Cthulhu Mythos Not to be confused with Anathoth, Astaroth, Ashtoreth, Ataroth, or Azeroth. This article is about a deity in fiction. For the short story named after it, see Azathoth (short story). Fictional character AzathothCthulhu Mythos characterArtist's depiction of AzathothFirst appearanceAzathothCreated byH. P. LovecraftIn-universe informationSpeciesOuter GodTitleNuclear ChaosDaemon SultanBlind Idiot GodLord of All ThingsChildrenNyarlathotep (son)Nameless Mist (of...

Letak Gordexola di Vizcaya Gordexola merupakan nama kota di Spanyol. Kota ini terletak di wilayah otonomi Pais Vasco. Pada tahun 2005, kota ini memiliki jumlah penduduk sebanyak 1.583 jiwa. Kota ini terleak 20 km dari Bilbao. Artikel bertopik geografi atau tempat Spanyol ini adalah sebuah rintisan. Anda dapat membantu Wikipedia dengan mengembangkannya.lbs

Fabio Mangone (Milano, 1587 – Milano, 1629) è stato un architetto italiano. Facciata di Santa Maria Podone a Milano (dopo il 1626). Indice 1 Biografia 2 Note 3 Bibliografia 4 Voci correlate 5 Altri progetti Biografia Fabio Mangone era nato a Milano ma da famiglia caravaggina, il padre Giovanbattista era morto a Milano il marzo 1627, mentre lavorava come capomastro alla fabbrica del Duomo.[1] I suoi primi anni di apprendimento li compì presso il laboratorio del padre, dove poteva v...

This article is about the American football season in the United States. For the Gaelic football season in Ireland, see 2010 National Football League (Ireland). 2010 National Football League season 2010 NFL seasonRegular seasonDurationSeptember 9, 2010 – January 2, 2011PlayoffsStart dateJanuary 8, 2011 – January 23, 2011[1]AFC ChampionsPittsburgh SteelersNFC ChampionsGreen Bay PackersSuper Bowl XLVDateFebruary 6, 2011[2]SiteCowboys Stadium, Arlington, Texas ChampionsGreen ...

أسبانيا Royaume d’Espagne مملكة إسبانيا دولة عميلة للإمبراطورية الفرنسية 1808 – 1813 مملكة إسبانيا النابليونيةالعلم مملكة إسبانيا النابليونيةالشعار الملكي الشعار الوطني : Plus Ultra [لغات أخرى]أكثر بعدا النشيد : Marcha Realنشيد ملكي أراضي مزعومة، وإن لم تتم السيطرة الفع...

American baseball player (born 1998) Baseball player McKinley MooreMoore with the Somerset Patriots in 2024New York Yankees PitcherBorn: (1998-08-24) August 24, 1998 (age 25)Houston, Texas, U.S.Bats: RightThrows: RightMLB debutApril 10, 2023, for the Philadelphia PhilliesMLB statistics (through 2023 season)Win–loss record0–0Earned run average18.90Strikeouts2 Teams Philadelphia Phillies (2023) McKinley David Moore (born August 24, 1998) is an American professional base...

See also: Anti-submarine missile Self-propelled underwater weapon This article is about the self-propelled weapon. For the pre-1900 naval meaning of torpedo, see Naval mine. For other uses, see Torpedo (disambiguation). Bliss–Leavitt Mark 8 torpedo A modern torpedo is an underwater ranged weapon launched above or below the water surface, self-propelled towards a target, and with an explosive warhead designed to detonate either on contact with or in proximity to the target. Historically, suc...

Malayalam cinema Before 1960 1960s 1960 1961 1962 1963 19641965 1966 1967 1968 1969 1970s 1970 1971 1972 1973 19741975 1976 1977 1978 1979 1980s 1980 1981 1982 1983 19841985 1986 1987 1988 1989 1990s 1990 1991 1992 1993 19941995 1996 1997 1998 1999 2000s 2000 2001 2002 2003 20042005 2006 2007 2008 2009 2010s 2010 2011 2012 2013 20142015 2016 2017 2018 2019 2020s 2020 2021 2022 2023 2024 vte This is a list of Malayalam films that released in 2020.[1] Released films The list of release...

Si ce bandeau n'est plus pertinent, retirez-le. Cliquez ici pour en savoir plus. Cet article relatif à la religion doit être recyclé (août 2022). Motif : L'essentiel de l'article ne traite pas du sujet ; pas de structure ni sources Améliorez-le, discutez des points à améliorer ou précisez les sections à recycler en utilisant {{section à recycler}}. Répartition du christianisme dans le monde. La chrétienté, avec une minuscule, désigne le monde chrétien, notion regroupa...

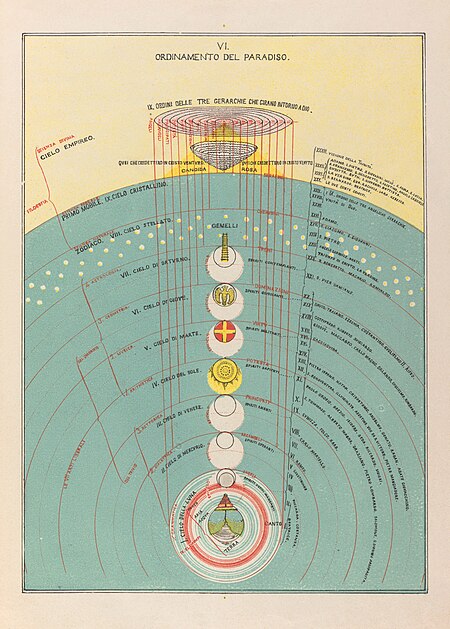

Hermetic starfire body For other uses, see Astral body (disambiguation). La materia della Divina commedia di Dante Alighieri, Plate VI: The Ordering of Paradise by Michelangelo Caetani (1804–1882) Part of a series onThelemaUnicursal hexagram The Rights of Man Holy Books and Stele The Book of the Law The Holy Books of Thelema The Stele of Revealing Key figures Ankh-af-na-Khonsu François Rabelais Aleister Crowley Victor Neuburg Charles Stansfeld Jones Jack Parsons Wilfred Talbot Smith Jane W...

Il Cisternone di Livorno Pasquale Poccianti (Bibbiena, 16 maggio 1774 – Firenze, 19 ottobre 1858[1]) è stato un architetto italiano, il principale esponente dello stile neoclassico in Toscana. Indice 1 Formazione 2 Attività 2.1 Livorno 2.2 Firenze 2.3 Poggio a Caiano 2.4 Altro 3 Altre immagini 4 Note 5 Bibliografia 6 Voci correlate 7 Altri progetti 8 Collegamenti esterni Formazione Facciata della villa medicea di Poggio Imperiale, Firenze Rimasto orfano del padre passò sotto la t...

Эта статья — о городе. О футбольном клубе см. Олесунн (футбольный клуб); об аэропорте см. Олесунн (аэропорт). Коммуна НорвегииОлесунннорв. Ålesund Герб Страна Норвегия Исторический регион Вестланн Губерния (фюльке) Мёре-ог-Ромсдал Адм. центр Олесунн Насе...

20th-century conflict between Poland and Russia This article is about the conflict of 1918–1921. For other Russo-Polish conflicts, see Polish–Russian Wars. This article may be too long to read and navigate comfortably. When this tag was added, its readable prose size was 18,000 words. Consider splitting content into sub-articles, condensing it, or adding subheadings. Please discuss this issue on the article's talk page. (October 2023) Polish–Soviet WarPart of Central and Eastern Europea...