Commodity market

|

Read other articles:

Nelson Mandela Square di malam hari Nelson Mandela Square adalah sebuah pusat perbelanjaan di Sandton, Johannesburg, Afrika Selatan. Tempat tersebut awalnya dikenal sebagai Sandton Square dan mengambil sebutan dari nama mantan Presiden Afrika Selatan dan aktivis anti-apartheid Nelson Mandela pada bulan Maret 2004. Sebuah patung Mandela setinggi enam meter didirikan pada acara penggantian nama tempat tersebut.[1][2] Referensi ^ http://www.southafrica.net/za/en/articles/entry/ar...

Mazmur 22Mazmur 22:1-8 dalam Kitab Mazmur St. Albans. Kata-kata pertama Mazmur ini dalam Vulgata (Alkitab versi bahasa Latin) adalah Deus, Deus meus, di sini disingkat sebagai DS DS MS.KitabKitab MazmurKategoriKetuvimBagian Alkitab KristenPerjanjian LamaUrutan dalamKitab Kristen19← Mazmur 21 Mazmur 23 → Mazmur 22 (disingkat Maz 22, Mzm 22 atau Mz 22; penomoran Septuaginta: Mazmur 21) adalah sebuah mazmur dalam bagian pertama Kitab Mazmur di Alkitab Ibrani dan Perjanjian Lama di Al...

Cet article est une ébauche concernant le sport et l’Arménie. Vous pouvez partager vos connaissances en l’améliorant (comment ?) selon les recommandations du projet sport. Comité national olympique d'Arménie Sigle ARMNOC Sport(s) représenté(s) Omnisports Création 1990 Président Gagik Tsarukyan Siège Erevan Site internet Site officiel modifier Le Comité national olympique arménien (en arménien Հայաստանի Ազգային Օլիմպիական Կոմիտե&...

Class of chemical compounds Immiscible layers of colored water (top) and much denser perfluoroheptane (bottom) in a beaker; a goldfish and crab cannot penetrate the boundary; coins rest at the bottom. Fluorocarbons are chemical compounds with carbon-fluorine bonds. Compounds that contain many C-F bonds often have distinctive properties, e.g., enhanced[clarification needed] stability, volatility, and hydrophobicity. Several fluorocarbons and their derivatives are commercial polymers, r...

JeepJenisDivisi dari Chrysler (sejak 1987) Divisi dari Stellantis (sejak 2021)IndustriMobilDidirikan1941Kantorpusat Toledo, Ohio, ASWilayah operasiGlobalTokohkunciChristian Meunier (CEO)ProdukSUVIndukStellantisSitus webwww.jeep.com Jeep adalah sebuah perusahaan multinasional yang menghasilkan berbagai macam produk mobil SUV. Perusahaan ini didirikan pada tahun 1941 Jeep menjadi bagian dari Chrysler sejak tahun 1987 dan pada tahun 2021 Jeep sudah menjadi bagian dari Stellantis. Jeep bermarkas ...

Protein-coding gene in the species Homo sapiens CLCN7IdentifiersAliasesCLCN7, CLC-7, CLC7, OPTA2, OPTB4, PPP1R63, chloride voltage-gated channel 7, HODExternal IDsOMIM: 602727 MGI: 1347048 HomoloGene: 56546 GeneCards: CLCN7 Gene location (Human)Chr.Chromosome 16 (human)[1]Band16p13.3Start1,444,934 bp[1]End1,475,084 bp[1]Gene location (Mouse)Chr.Chromosome 17 (mouse)[2]Band17 A3.3|17 12.53 cMStart25,352,365 bp[2]End25,381,078 bp[2]RNA expres...

Love Me Tenderposter film karya Tom ChantrellSutradaraRobert D. WebbStanley Hough (ass't)ProduserDavid WeisbartSkenarioRobert BucknerCeritaMaurice GeraghtyPemeranRichard EganDebra PagetElvis PresleyPenata musikLionel NewmanSinematograferLeo ToverPenyuntingHugh S. FowlerDistributor20th Century FoxTanggal rilis 15 November 1956 (1956-11-15) Durasi89 menitNegaraAmerika SerikatBahasaInggrisAnggaran$1,250,000[1]Pendapatankotor$4.5 juta (rental AS)[2] Love Me Tender adala...

「俄亥俄」重定向至此。关于其他用法,请见「俄亥俄 (消歧义)」。 俄亥俄州 美國联邦州State of Ohio 州旗州徽綽號:七葉果之州地图中高亮部分为俄亥俄州坐标:38°27'N-41°58'N, 80°32'W-84°49'W国家 美國加入聯邦1803年3月1日,在1953年8月7日追溯頒定(第17个加入联邦)首府哥倫布(及最大城市)政府 • 州长(英语:List of Governors of {{{Name}}}]]) •&...

Perang ketupat adalah acara adat di mana para peserta perang saling melempar ketupat sebagai senjata dalam perang ketupat. Di Indonesia perang ketupat terdapat di Bangka Belitung dan Bali. Perang Ketupat di Bangka Belitung Perang ketupat Di Bangka Belitung, tepatnya di pulau Bangka sering disebut dengan ruah tempilang. Acara ini diselenggarakan setiap masuk Minggu ke tiga bulan sya'ban untuk menyambut bulan Ramadhan di Pantai Tempilang, Tempilang, Bangka Barat. Pada saat acara ini berlangsung...

Частина серії проФілософіяLeft to right: Plato, Kant, Nietzsche, Buddha, Confucius, AverroesПлатонКантНіцшеБуддаКонфуційАверроес Філософи Епістемологи Естетики Етики Логіки Метафізики Соціально-політичні філософи Традиції Аналітична Арістотелівська Африканська Близькосхідна іранська Буддій�...

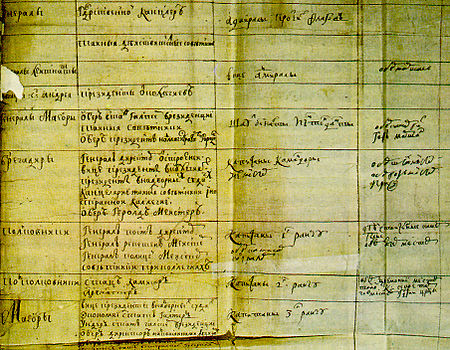

Peter the Great The government reforms of Peter I aimed to modernize the Tsardom of Russia (later the Russian Empire) based on Western European models. Peter ascended to the throne at the age of 10 in 1682; he ruled jointly with his half-brother Ivan V. After Ivan's death in 1696, Peter started his series of sweeping reforms. At first he intended these reforms to support the Great Northern War of 1700-1721; later, more systematic reforms significantly changed the internal structure and admini...

此條目没有列出任何参考或来源。 (2023年7月1日)維基百科所有的內容都應該可供查證。请协助補充可靠来源以改善这篇条目。无法查证的內容可能會因為異議提出而被移除。 救世军西北队是救世军在中国北京于20世纪上半叶建立的8座教堂之一,位于西城区育幼胡同8号(端王府夹道)。1950年代关闭。1980年代初列为普查登记在册文物。 查论编北京教堂天主教宣武门天主堂(主...

The Nebraska Public Service Commission regulates railroads, household goods and passenger carriers, telephone companies, grain warehouses and construction of manufactured housing (mobile homes). The Nebraska PSC is composed of five commissioners. The current commissioners, as of 2019, are Dan Watermeier, Crystal Rhoades, Tim Schram, Rod Johnson and Mary Ridder. External links Nebraska Public Service Commission Website vte Nebraska statewide elected officials Governor Lieutenant Governor Secre...

Voce principale: Unione Sportiva Salernitana 1919. Unione Sportiva SalernitanaStagione 1972-1973Sport calcio Squadra Salernitana Allenatore Giancarlo Vitali(fino al 14/09/1972) Nicola Chiricallo(dal 14/09/1972) All. in seconda Mario Saracino Presidente Amerigo Vessa Serie C5º posto Coppa Italia SemiprofessionistiFase a gironi Maggiori presenzeCampionato: Bassi, Pigozzi, Urbani (37) Miglior marcatoreCampionato: Busilacchi (14)Totale: Busilacchi (14) StadioDonato Vestuti (9.000)[1 ...

Type of analogue fire-control system The examples and perspective in this article may not represent a worldwide view of the subject. You may improve this article, discuss the issue on the talk page, or create a new article, as appropriate. (December 2010) (Learn how and when to remove this message) Mark 37 Director c1944 with Mark 12 (rectangular antenna) and Mark 22 orange peel Ship gun fire-control systems (GFCS) are analogue fire-control systems that were used aboard naval warships prior t...

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages) This article may require cleanup to meet Wikipedia's quality standards. The specific problem is: This article contains what may be an unencyclopedic or excessive gallery of images; galleries containing indiscriminate images of the article subject are discouraged. Please help improve this article if you can. (October 2018) (Learn how and when to remo...

Unità militari Unità Numero di soldati Grado del comandante Gruppo di fuoco 2-5 Caporale SquadraCarroPezzo 10-151 carro1 pezzo Caporal maggiore,Sergente PlotonePlotone carriSezione 30-504 carri2 o più pezzi Maresciallo,Sottotenente,Tenente CompagniaSquadroneBatteria 100-25010-20 carrivariabile Tenente,Capitano BattaglioneGruppo 500-1.000 Maggiore,Tenente colonnello, Reggimento 1.500-3.000 Colonnello Brigata 4.000-6.000 Generale di brigata Divisione 10.00030.000 Generale di divisione Corpo...

Cet article est une ébauche concernant une localité italienne et la Lombardie. Vous pouvez partager vos connaissances en l’améliorant (comment ?) selon les recommandations des projets correspondants. Calvagese della Riviera Armoiries Drapeau Administration Pays Italie Région Lombardie Province Brescia Code postal 25080 Code ISTAT 017033 Code cadastral B436 Préfixe tel. 030 Démographie Population 3 501 hab. (31-12-2010[1]) Densité 318 hab./km2 Géograp...

Electronic assembly containing multiple integrated circuits that behaves as a unit This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Multi-chip module – news · newspapers · books · scholar · JSTOR (June 2013) (Learn how and when to remove this message) A ceramic multi-chip module containing four POWER5 process...

This article is about the barony of Dufferin in Northern Ireland. For other uses, see Dufferin. Place in Northern Ireland, United KingdomDufferin An Duifrian[1] (Irish)Location of Dufferin, County Down, Northern Ireland.Sovereign stateUnited KingdomCountryNorthern IrelandCountyDown Dufferin (from Irish [A]n Duibhthrian, meaning 'the black third'[2]) is a historic barony in County Down, Northern Ireland.[3] It is on the southern half of the west shore of Strangford Loug...