Asset price channel

|

Read other articles:

Untuk likeur beraroma jeruk pahit, lihat Curaçao (likeur). Negara CuraçaoLand Curaçao (Belanda)Pais Kòrsou (Papiamentu) Bendera Lambang Semboyan: —Lagu kebangsaan: Himno di KòrsouIbu kota(dan kota terbesar)Willemstad12°7′N 68°56′W / 12.117°N 68.933°W / 12.117; -68.933Bahasa resmiBelanda dan PapiamentuPemerintahanMonarki konstitusional• Raja Willem-Alexander• Gubernur Lucille George-Wout• Perdana Menteri Eugene Rhuggenaath L...

Brooke BrodackBrodack at the ROFLCon in 2008.LahirBrooke Allison Brodack7 April 1986 (umur 37)Putnam, Connecticut, Amerika SerikatNama lainBrooke AlleyTahun aktif30 September 2005 – sekarangDikenal atasKomedi, ParodiInformasi InternetWeb aliasBrookersLayanan hos webYouTube, MySpace, Revver, Blogtv Brooke Allison Brodack (lahir 7 April 1986), aka Brookers, adalah pelawak video viral Amerika Serikat terutama dikenal untuk video pendeknya di YouTube, yang telah menerima 49 juta...

MariaRatu Maria oleh Charles van Loo, 1748Ratu Prancis dan NavarraPeriode4 September 1725 – 24 Juni 1768Informasi pribadiKelahiran(1703-06-23)23 Juni 1703Trzebnica, PolandiaKematian24 Juni 1768(1768-06-24) (umur 65)Versailles, PrancisPemakamanBasilika Saint-Denis, Paris, PrancisWangsaLeszczyńskiNama lengkapMaria Karolina Zofia Felicja LeszczyńskaAyahStanisław I of PolandIbuCatherine OpalińskaPasanganLouis XV dari PrancisAnakLouise Élisabeth, Adipati Wanita ParmaPutri HenriettePutr...

Taman Nasional Pegunungan RwenzoriIUCN Kategori II (Taman Nasional)Pegunungan RwenzoriLokasi Taman Nasional Pegunungan RwenzoriLetakDistrik Kasese, UgandaKota terdekatKaseseKoordinat00°22′N 29°57′E / 0.367°N 29.950°E / 0.367; 29.950Koordinat: 00°22′N 29°57′E / 0.367°N 29.950°E / 0.367; 29.950Luas998 kilometer persegi (385 sq mi)Pihak pengelolaOtoritas Pelestarian Alam Uganda Situs Warisan Dunia UNESCOJenisAlamiKriteriav...

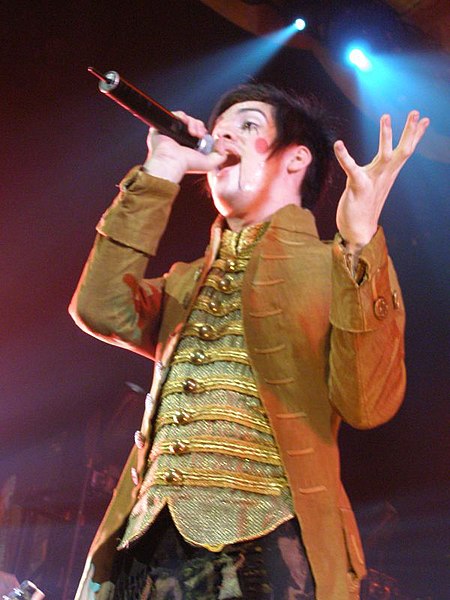

Brendon UrieUrie pada tahun 2013Lahir12 April 1987 (umur 36)St. George, Utah, Amerika SerikatPekerjaanPenyanyi, penulis lagu, musisiTahun aktif2004-kiniSuami/istriSarah Orzechowski (m. 2013)Karier musikGenre Rock alternatif pop rock pop punk Instrumen Vokal gitar piano drum gitar bass Label Decaydance Fueled by Ramen Artis terkait Panic! at the Disco Brendon Boyd Urie (lahir 12 April 1987) adalah penyanyi dan multi-instrumentalis berkebangsaan Amerika...

2 Pallas PenemuanDitemukan olehHeinrich Wilhelm OlbersTanggal penemuan28 Maret 1802PenamaanPelafalan[ˈpæləs][note 1]Asal namaPallas AthenaKategori planet minorKeluarga PallasKata sifat bahasa InggrisPalladian[1]Ciri-ciri orbit[1][3]Epos 22 Agustus 2008 (Hari Julian 2454700,5)Aphelion3,412 SA (510,468 Gm)Perihelion2,132 SA (319,005 Gm)Sumbu semimayor2,772 SA (414,737 Gm)Eksentrisitas0,231Periode orbit4,62 a (1686,044 hr)Kecepatan orbit rata-r...

Federal police force in India Central Industrial Security ForceParent Agency - Ministry of Home AffairsEmblem of the CISFFlag of the CISFAbbreviationCISFMottoProtection and SecurityAgency overviewFormed10 March 1969; 55 years ago (1969-03-10)Employees163,590 Active Personnel[citation needed][1]Annual budget₹13,655.84 crore (US$1.7 billion) (2024–25)[2]Jurisdictional structureOperations jurisdictionIndiaGoverning bodyMinistry of Home Affairs (...

Church in Bogense, DenmarkSaint Nicholas ChurchBogense KirkeSankt Nicolaj KirkeLocationBogense, DenmarkDenominationChurch of DenmarkWebsitehttp://www.bogensekirke.dk/ArchitectureCompletedc. 1450AdministrationDioceseDiocese of FunenParishBogense Sogn Saint Nicholas Church (Danish: Sankt Nikolaj Kirke), also Bogense Church, is located in the harbour town of Bogense on the Danish island of Funen. It was built in 1406 on the remains of a 12th-century Romanesque church. In the mid-15th century, va...

United States women's national baseball teamInformationCountryUnited StatesFederationUSA BaseballConfederationCOPABEWBSC rankingCurrent 4 (22 September 2023)[1]Women's World CupAppearances6 (first in 2004)Best result1st (2 times, in 2004 and 2006) The United States women's national baseball team is a national team that represents the United States of America in international women's baseball competitions. It is controlled by USA Baseball and is a member of the Pan American Baseball Co...

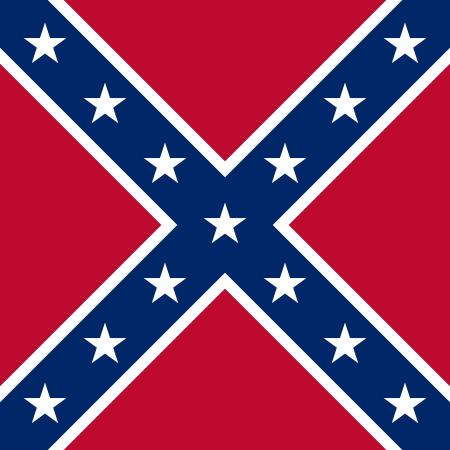

Questa voce sugli argomenti insegnanti statunitensi e scrittori statunitensi è solo un abbozzo. Contribuisci a migliorarla secondo le convenzioni di Wikipedia. Segui i suggerimenti del progetto di riferimento. Evander LawNascitaDarlington, 7 agosto 1836 MorteBartow, 31 ottobre 1920 Dati militariPaese servitoStati Confederati d'America Forza armata Confederate States Army Anni di servizio1861 - 1865 GradoBrigadier generale GuerreGuerra di secessione americana Comandante diH...

Православная церковь Чешских земель и Словакиичеш. Pravoslavná církev v českých zemích a na Slovenskuсловацк. Pravoslávna cirkev v českých krajinách a na Slovenskuцерк.-слав. Правосла́внаѧ цр҃ковь че́шскихъ земе́ль и҆ слова́кїи Кафедральный собор Святых Кирилла и Мефодия в Праге Общие сведения Основатели Равн...

Diacritical mark, the dot element of the letters i and j For the surname, see Tittle (surname). Not to be confused with title or tilde. Lowercase i and j in Liberation Serif, with tittles in red. A tittle or superscript dot[1] is a small distinguishing mark, such as a diacritic in the form of a dot on a letter (for example, lowercase i or j). The tittle is an integral part of the glyph of i and j, but diacritic dots can appear over other letters in various languages. In most languages...

ميل مي-26 Миль Ми-26مروحية مي-26 تابعة للقوات الجوية الروسيةمعلومات عامةالنوع مروحيةبلد الأصل الاتحاد السوفيتي روسياالتطوير والتصنيعالصانع ميل موسكوسنة الصنع 1981الكمية المصنوعة 276سيرة الطائرةدخول الخدمة 1983أول طيران 12 ديسمبر 1977الخدمةالمستخدم الأساسي القوات الجوية ا�...

Частина серії проФілософіяLeft to right: Plato, Kant, Nietzsche, Buddha, Confucius, AverroesПлатонКантНіцшеБуддаКонфуційАверроес Філософи Епістемологи Естетики Етики Логіки Метафізики Соціально-політичні філософи Традиції Аналітична Арістотелівська Африканська Близькосхідна іранська Буддій�...

History of the flight simulator series This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: History of Microsoft Flight Simulator – news · newspapers · books · scholar · JSTOR (July 2020) (Learn how and when to remove this message)Microsoft Flight Simulator began as a set of articles on computer graphics, written...

Former Indian Defence Minister Krishna Menon redirects here. For the guru, see Atmananda Krishna Menon. V. K. Krishna MenonMenon, c. 1950sUnion Minister for DefenceIn office17 April 1957 – 31 October 1962Prime MinisterJawaharlal NehruPreceded byKailash Nath KatjuSucceeded byYashwantrao ChavanPermanent Representative of India to the United NationsIn office1952–1962PresidentRajendra Prasad Sarvepalli RadhakrishnanPrime MinisterJawaharlal NehruMember of Parliament, Lok SabhaIn...

American gossip columnist (1881–1972) Louella ParsonsParsons in 1937BornLouella Rose Oettinger(1881-08-06)August 6, 1881Freeport, Illinois, U.S.DiedDecember 9, 1972(1972-12-09) (aged 91)Santa Monica, California, U.S.Resting placeHoly Cross CemeteryOccupations Gossip columnist screenwriter Years active1902–1965Spouses John Dement Parsons (m. 1905; div. 1914) John McCaffrey Jr. (m. 1915; div.&#...

Artikel ini perlu diwikifikasi agar memenuhi standar kualitas Wikipedia. Anda dapat memberikan bantuan berupa penambahan pranala dalam, atau dengan merapikan tata letak dari artikel ini. Untuk keterangan lebih lanjut, klik [tampil] di bagian kanan. Mengganti markah HTML dengan markah wiki bila dimungkinkan. Tambahkan pranala wiki. Bila dirasa perlu, buatlah pautan ke artikel wiki lainnya dengan cara menambahkan [[ dan ]] pada kata yang bersangkutan (lihat WP:LINK untuk keterangan lebih lanjut...

Religion in Ethiopia (2016 estimate)[1] Ethiopian Orthodoxy (43.8%) P'ent'ay (22.8%) Other Christian (0.7%) Islam (31.3%) Traditional faiths (0.6%) Other / None (0.8%) Holy Trinity Ethiopian Orthodox Cathedral in Addis Ababa. Ethiopia was one of the first regions in the world to adopt Christianity. Religion in Ethiopia consists of a number of faiths. Among these mainly Abrahamic religions, the most numerous is Christi...

American politician (born 1945) Carolyn Cheeks KilpatrickMember of theU.S. House of Representativesfrom MichiganIn officeJanuary 3, 1997 – January 3, 2011Preceded byBarbara-Rose CollinsSucceeded byHansen ClarkeConstituency15th district (1997–2003)13th district (2003–2011)Member of theMichigan House of RepresentativesIn officeJanuary 1, 1979 – January 1, 1997Preceded byJackie Vaughn IIISucceeded byKwame KilpatrickConstituency18th district (1979–1982)8th district (19...