130–30 fund

|

Read other articles:

معتمدية السبالة تقسيم إداري البلد تونس[1] التقسيم الأعلى ولاية سيدي بوزيد رمز جيونيمز 11106669 تعديل مصدري - تعديل معتمدية السبالة إحدى معتمديات الجمهورية التونسية، تابعة لولاية سيدي بوزيد.[2] مراجع ^ صفحة معتمدية السبالة في GeoNames ID. GeoNames ID. اطلع عليه...

I'm Your ManSampul Type BSingel oleh 2PMdari album Republic of 2PMSisi-BWithout U (Versi Jepang)Dirilis17 Agustus 2011 (2011-08-17)FormatCD single, digital downloadDirekam2011GenrePop, Dance-pop, J-popDurasi3:12LabelAriola Japan I'm Your Man adalah singel kedua berbahasa Jepang kedua boy band asal Korea Selatan, 2PM. Singel ini dirilis pada tanggal 17 Agustus 2011 dan dirilis dalam 3 edisi yaitu CD+DVD, CD+Photobook dan edisi reguler.[1] Daftar lagu Seluruh lirik ditulis oleh J.Y...

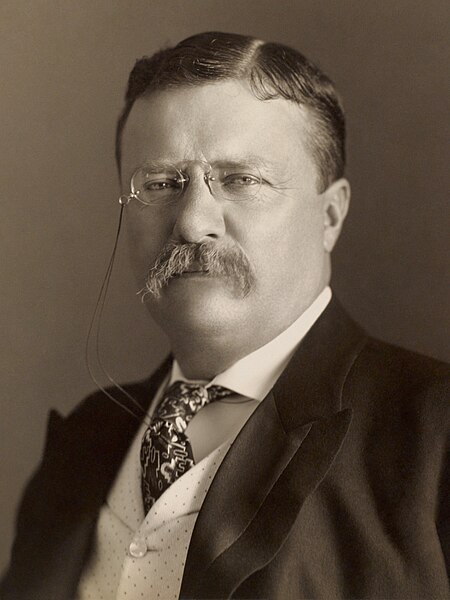

Main article: 1904 United States presidential election 1904 United States presidential election in New York ← 1900 November 8, 1904 1908 → Turnout83.3%[1] 1.3 pp Nominee Theodore Roosevelt Alton B. Parker Party Republican Democratic Home state New York New York Running mate Charles W. Fairbanks Henry G. Davis Electoral vote 39 0 Popular vote 859,533 683,981 Percentage 53.13% 42.28% County Results Roosevelt 40-50% ...

Australian operator of theme parks and other leisure venues Coast Entertainment HoldingsTraded asASX: CEHIndustryLeisure and Entertainment Attraction OperatorPredecessorMacquarie Leisure TrustFounded11 June 1998; 25 years ago (1998-06-11) (as Macquarie Leisure Trust)HeadquartersMilsons Point, New South Wales, AustraliaKey peopleSimon Kelly (CEO & MD) since 9 June 2017[1][2]RevenueA$350.4m (2010)[3][4]Operating incomeA$78.8m (2010)[...

نموذج لوحة تسجيل مركبات في السودان معروضة في مصنع لوحات وعلامات المرور لوحات تسجيل المركبات السودانية، هي لوحات معدنية مصنوعة من شريحة رقيقة من الألمونيوم وأكثرمايميزها أنها مغطاة بطبقة بلاستيكية لاصقة عاكسة للضوء كما يضاف لها شريط هولوجرام لتأمينها أما الآن فإستبدل ال�...

Ini adalah nama Korea; marganya adalah Kim. Kim Jae-ryong김재룡 Perdana Menteri Korea Utara ke-12Masa jabatan11 April 2019 – 13 Agustus 2020Pemimpin TertinggiKim Jong-un PendahuluPak Pong-juPenggantiKim Tok-hunAnggota Majelis Tertinggi Rakyat untuk HuichonPetahanaMulai menjabat 10 Maret 2019 PendahuluCho Jae-yongPenggantiPetahanaSekretaris Komite Partai Buruh Korea Provinsi ChagangMasa jabatan2016–2019 Pendahulu?PenggantiKang Bong-hun Informasi pribadiPartai politikPartai ...

This article uses bare URLs, which are uninformative and vulnerable to link rot. Please consider converting them to full citations to ensure the article remains verifiable and maintains a consistent citation style. Several templates and tools are available to assist in formatting, such as reFill (documentation) and Citation bot (documentation). (August 2022) (Learn how and when to remove this template message) Neighbourhood in Bangalore, Karnataka, IndiaHSR LayoutNeighbourhoodA park in HSR La...

Football team of Eastern Michigan University Eastern Michigan Eagles football2023 Eastern Michigan Eagles football team First season1891Athletic directorScott WetherbeeHead coachChris Creighton 9th season, 40–60 (.400)StadiumRynearson Stadium(capacity: 30,200)Field surfaceFieldTurfLocationYpsilanti, MichiganNCAA divisionDivision I FBSConferenceMid-American ConferenceDivisionWestPast conferencesMIAA (1894–1926)MCC (1927–1930)IIAC (1950–1961)PAC (1964–1965)All-time record490–623...

Argentine footballer (born 1987) Claudio Yacob Yacob playing for West Bromwich Albion in 2012Personal informationFull name Claudio Ariel Yacob[1]Date of birth (1987-07-18) 18 July 1987 (age 36)Place of birth Carcarañá, ArgentinaHeight 1.81 m (5 ft 11 in)[2]Position(s) Defensive midfielderYouth career2001–2006 Racing ClubSenior career*Years Team Apps (Gls)2006–2012 Racing Club 144 (7)2012–2018 West Bromwich Albion 160 (2)2018–2020 Nottingham Forest...

1808 Pennsylvania gubernatorial election ← 1805 October 11, 1808 (1808-10-11) 1811 → Nominee Simon Snyder James Ross Party Democratic-Republican Federalist Popular vote 67,975 39,575 Percentage 60.9% 35.5% County ResultsSnyder: 50-60% 60-70% 70-80% 80-90%Ross: 40-50% ...

2016年美國總統選舉 ← 2012 2016年11月8日 2020 → 538個選舉人團席位獲勝需270票民意調查投票率55.7%[1][2] ▲ 0.8 % 获提名人 唐納·川普 希拉莉·克林頓 政党 共和黨 民主党 家鄉州 紐約州 紐約州 竞选搭档 迈克·彭斯 蒂姆·凱恩 选举人票 304[3][4][註 1] 227[5] 胜出州/省 30 + 緬-2 20 + DC 民選得票 62,984,828[6] 65,853,514[6]...

This template does not require a rating on Wikipedia's content assessment scale.It is of interest to the following WikiProjects:Chemistry This template is within the scope of WikiProject Chemistry, a collaborative effort to improve the coverage of chemistry on Wikipedia. If you would like to participate, please visit the project page, where you can join the discussion and see a list of open tasks.ChemistryWikipedia:WikiProject ChemistryTemplate:WikiProject ChemistryChemistry articles This tem...

هذه المقالة بحاجة لصندوق معلومات. فضلًا ساعد في تحسين هذه المقالة بإضافة صندوق معلومات مخصص إليها. نقش هيلينستي يمثل الأولمبيين الإثنى عشر وكل منهم يحمل الشيء الذي اشتهر به في الدين والأساطير الإغريقية، الأولمبيون الاثنا عشر (باليونانية: Δώδεκα θεοί του Ολύμπου) هم الآل�...

شركة أحادية القرن أو شركة يوني كورن مصطلح اقتصادي يطلق على الشركات الصاعدة التي يتخطى رأسمالها مليار دولار،[1] اُستخدم هذا المصطلح لأول مرة عام 2013 من خلال الخبيرة المالية الأمريكية أيليين لي والتي وصفته في مقالة لها بـ«نادي أحادي القرن» (بالإنجليزية: Unicorn Club) وذلك على...

Kaiseki terdiri dari serangkaian hidangan, sering kali berukuran kecil dan dirangkai secara artistik Kaiseki (懐石code: ja is deprecated ) atau kaiseki-ryōri (懐石料理code: ja is deprecated ) adalah sebuah makan malam Jepang beragam hidangan tradisional. Istilah tersebut juga merujuk kepaa sejumlah keterampilan dan teknik yang dilakukan dalam menyajikan hidangan-hidangan semacam itu, mirip dengan seni adiboga di dunia Barat.[1] Referensi ^ Bourdain, Anthony (2001). A Cook's Tou...

Michael TrotobasBiographieNaissance 30 mai 1914BrightonDécès 27 novembre 1943 (à 29 ans)LilleSépulture Cimetière du Sud de LilleNom de naissance Michael Alfred Raymond TrotobasSurnoms Capitaine Michel, Trott, Joseph RampalNationalité britanniqueActivité EspionAutres informationsConflit Seconde Guerre mondialeDistinctions Citation militaire britanniqueMédaille de la Résistancemodifier - modifier le code - modifier Wikidata Michael Trotobas, né le 30 mai 1914 à Brighton, dans le...

For other uses, see Open Europe (disambiguation). Think-tank promoting a campaign for EU change Open EuropeFormation2005; 19 years ago (2005)DissolvedJanuary 2020Legal statusPrivate companyPurposeOriginal research into the UK's relationship with the EUHeadquartersLondon, United Kingdom BrusselsActing DirectorStephen Booth Open Europe's London Office William Hague giving a speech to Open Europe on 16 July 2013 Open Europe's EU War Game negotiation simulation with former Irish...

Mari Yaguchi矢口真里Mari Yaguchi, Oktober 2009.Informasi latar belakangNama lahirMari YaguchiNama lainMarippe, Yaguchan, YaguttsanLahir20 Januari 1983 (umur 41)Izumi-ku, Yokohama, Prefektur Kanagawa, JepangAsalTokyoGenrepopPekerjaanpenyanyi, aktris, tarentoTahun aktif1998–sekarangLabelZetima, hachamaArtis terkaitMorning Musume (1998–2005)ZYXROMANSTanpopoMinimoniMorning Musume SakuragumiHello! Project shuffle unitsDream Morning Musume (2011–) Mari Yaguchi (矢口真里code: ja i...

Highway in Kentucky This article is about the section of U.S. Route 62 in Kentucky. For the entire route, see U.S. Route 62. U.S. Route 62US 62 highlighted in redRoute informationMaintained by KYTCLength391.207 mi[1] (629.587 km)Existed1930–presentMajor junctionsWest end US 51 / US 60 / US 62 at Cairo Ohio River Bridge near Cairo, ILMajor intersections I-24 in Paducah I-24 / I-69 in Calvert City I-24 / I-69 in Kuttawa I-69 ...

صبحي توفيق صبحي توفيق ضيف قناة إم تي في، 7 مارس 2020 معلومات شخصية اسم الولادة صبحي توفيق درويش حدادة[1] الميلاد 20 ديسمبر 1968 (العمر 55 سنة)برجا مواطنة لبنان عضو في نقابة الفنانين المحترفين في لبنان[2] الحياة الفنية الآلات الموسيقية العود المهنة مغني سنوات النشاط 1994 - �...