Thomas J. Sargent

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Read other articles:

Artikel ini sebatang kara, artinya tidak ada artikel lain yang memiliki pranala balik ke halaman ini.Bantulah menambah pranala ke artikel ini dari artikel yang berhubungan atau coba peralatan pencari pranala.Tag ini diberikan pada Maret 2016. Manhattan Regional AirportIATA: MHKICAO: KMHKFAA LID: MHKInformasiJenisPublikPemilikCity of ManhattanMelayaniManhattan, KansasKetinggian dpl mdplSitus webFlyMHK.comPetaMHKLocation of airport in KansasLandasan pacu Arah Panjang Permukaan kaki m ...

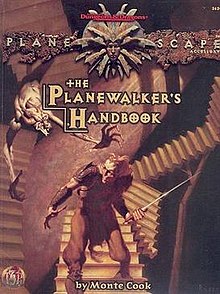

The Planewalker's Handbook AuthorMonte CookGenreRole-playing gamesPublisherTSRPublication date1996ISBN0-7869-0460-7 The Planewalker's Handbook is an accessory for the Planescape campaign setting in the 2nd edition of the Advanced Dungeons & Dragons fantasy role-playing game, published in 1996. Contents The Planewalker's Handbook is a supplement which aims to be a practical guide for Planescape players, pulling facts from many different sources as an encyclopedia of different topics in the...

Artikel ini perlu diwikifikasi agar memenuhi standar kualitas Wikipedia. Anda dapat memberikan bantuan berupa penambahan pranala dalam, atau dengan merapikan tata letak dari artikel ini. Untuk keterangan lebih lanjut, klik [tampil] di bagian kanan. Mengganti markah HTML dengan markah wiki bila dimungkinkan. Tambahkan pranala wiki. Bila dirasa perlu, buatlah pautan ke artikel wiki lainnya dengan cara menambahkan [[ dan ]] pada kata yang bersangkutan (lihat WP:LINK untuk keterangan lebih lanjut...

American lawyer, politician, and U.S. Senator from Arkansas Senator McClellan redirects here. For other uses, see Senator McClellan (disambiguation). John L. McClellanMcClellan in 1970United States Senatorfrom ArkansasIn officeJanuary 3, 1943 – November 28, 1977Preceded byLloyd SpencerSucceeded byKaneaster Hodges Jr.Member of the U.S. House of Representativesfrom Arkansas's 6th districtIn officeJanuary 3, 1935 – January 3, 1939Preceded byDavid D. GloverSuccee...

First Vice President of Afghanistan from 2020 to 2021 Amrullah Salehامرالله صالحSaleh in 2011First Vice President of AfghanistanIn office19 February 2020 – 15 August 2021PresidentAshraf GhaniPreceded byAbdul Rashid DostumSucceeded bySirajuddin Haqqani (as First Deputy Leader)Acting Interior Minister of AfghanistanIn office23 December 2018 – 19 January 2019PresidentAshraf GhaniPreceded byWais BarmakSucceeded byMasoud AndarabiHead of the National Directorate of ...

City in Tehran province, Iran For other places with a similar name, see Ab-e Sard. City in Tehran, IranAbsard Persian: آبسردCityAbsardCoordinates: 35°37′10″N 52°09′07″E / 35.61944°N 52.15194°E / 35.61944; 52.15194[1]CountryIranProvinceTehranCountyDamavandDistrictCentralElevation1,700−2,000 m (−4,900 ft)Population (2016)[2] • Total10,648Time zoneUTC+3:30 (IRST) Absard (Persian: آبسرد), also Romanized a...

Este artigo ou secção contém uma lista de referências no fim do texto, mas as suas fontes não são claras porque não são citadas no corpo do artigo, o que compromete a confiabilidade das informações. Ajude a melhorar este artigo inserindo citações no corpo do artigo. (Janeiro de 2019) Kaiserthum Österreich Império Austríaco Parte do Sacro Império Romano-Germânicoa (1804–1806)Parte da Confederação Germânicaa (1815–1866) ← ← ← 1804 – 1867 →...

Kanker HatiTomografi terkomputasi Hati dengan KolangiokarsinomaInformasi umumNama lainKanker Hati PrimerSpesialisasiGastroenterologi Hepatologi OncologyPenyebabHepatitis B, Hepatitis C, Alkohol, Aflatoksin, Penyakit perlemakan hati non-alkoholik, Cacing hati[1][2]Aspek klinisGejala dan tandaBenjolan atau nyeri di sisi kanan bawah tulang rusuk, pembengkakan perut, kulit kekuningan, mudah memar, penurunan berat badan, kelemahan[3]Awal muncul55 hingga 65 tahun[4]D...

Robin StjernbergRobin Stjernberg in May 2013.Background informationBirth nameRobin James Olof StjernbergBorn (1991-02-22) 22 February 1991 (age 33)Hässleholm, SwedenGenresPopOccupation(s)SingerInstrument(s)VocalsYears active2006 – presentLabelsFreebird EntertainmentLionheart Music GroupUniversal MusicWebsitehttps://robinstjernberg.com/Musical artist Robin James Olof Stjernberg (Swedish pronunciation: [ˈrɔ̌bːɪn ˈɧæ̂ːɳbærj]; born 22 February 1991, Häss...

Федеральное агентство по делам Содружества Независимых Государств, соотечественников, проживающих за рубежом, и по международному гуманитарному сотрудничествусокращённо: Россотрудничество Общая информация Страна Россия Юрисдикция Россия Дата создания 6 сентября...

Summerhouse in Lancashire, EnglandLindeth TowerLocation within the City of Lancaster districtGeneral informationTypeSummerhouseLocationSilverdale, LancashireCountryEnglandCoordinates54°09′37″N 2°49′35″W / 54.1603°N 2.8265°W / 54.1603; -2.8265Completed1842Technical detailsMaterialLimestone rubbleFloor count3Design and constructionArchitect(s)H.P. Fleetwood Listed Building – Grade IIDesignated2 May 1968Reference no.1071845 Lindeth Tower is a Victorian...

Highest court of American Samoa, after the U.S. Supreme Court High Court of American SamoaThe High Court of American Samoa courthouseEstablished1921 (103 years ago)LocationFagatogo, American SamoaComposition methodappointed by the United States Secretary of the InteriorAuthorized byConstitution of American SamoaAppeals toUnited States Secretary of the Interior (no appeals in practice)[1]Number of positions2Chief JusticeCurrentlyMichael KruseSince1988 The High Court of American Samoa i...

莱什诺Leszno莱什诺Leszno坐标:51°48′N 16°36′E / 51.8°N 16.6°E / 51.8; 16.6国家 波蘭省大波兰省面积 • 总计31.9 平方公里(12.3 平方英里)人口(2008年) • 總計71,000人 • 密度2,226人/平方公里(5,765人/平方英里)时区CET(UTC+1) • 夏时制CEST(UTC+2)網站http://www.leszno.pl 莱什诺(波兰语:Leszno,[ˈlɛʂnɔ] 试听;Lissa)是�...

Municipality in Castile and León, SpainRioseco de SoriaMunicipality FlagSealRioseco de SoriaLocation in Spain.Show map of Castile and LeónRioseco de SoriaRioseco de Soria (Spain)Show map of SpainCoordinates: 41°39′00″N 2°50′00″W / 41.6500°N 2.8333°W / 41.6500; -2.8333Country SpainAutonomous community Castile and LeónProvince SoriaMunicipalityRioseco de SoriaArea • Total49 km2 (19 sq mi)Elevation1,009 m (3,31...

Cupa României 2006-2007 Competizione Cupa României Sport Calcio Edizione 69ª Organizzatore FRF Date dal 24 ottobre 2006al 26 maggio 2007 Luogo Romania Partecipanti 32 Risultati Vincitore Rapid Bucarest(13º titolo) Secondo FCU Poli Timișoara Cronologia della competizione 2005-2006 2007-2008 Manuale La Cupa României 2006-2007 è stata la 69ª edizione della coppa nazionale disputata tra il 24 ottobre 2006 e il 26 maggio 2007 e conclusa con la vittoria del Rapid Bucarest, al...

Carlos Lamarca Carlos Lamarca (date inconnue). Données clés Naissance 23 octobre 1937 Rio de Janeiro Décès 17 avril 1971 (à 33 ans) Ipupiara (Bahia) Nationalité brésilienne Profession militaire (capitaine) Activité principale guérilla (menée contre la dictature militaire) Formation Académie militaire des Agulhas Negras à Resende Distinctions promotion posthume au grade de colonel (2007) Famille Maria Pavan (épouse), deux enfants modifier Carlos Lamarca (Rio de Janeiro, 1937...

セルネックス・テレコムCellnex Telecom, S.A. 種類 公開会社市場情報 BMAD: CLNX本社所在地 スペイン08040Avinguda Parc Logístic 12-20, バルセロナ設立 2015年4月1日 (9年前) (2015-04-01)業種 通信代表者 トビアス・マルティネス・ヒメノ(CEO)外部リンク コーポレートサイトテンプレートを表示 セルネックス・テレコム(西: Cellnex Telecom, S.A.)は、無線通信インフラおよび放送...

Early attempt to explain constant speed of light In the 19th century, the theory of the luminiferous aether as the hypothetical medium for the propagation of light waves was widely discussed. The aether hypothesis arose because physicists of that era could not conceive of light waves propagating without a physical medium in which to do so. When experiments failed to detect the hypothesized luminiferous aether, physicists conceived explanations for the experiments' failure which preserved the ...

1st-century CE set of 42 Christian poems Not to be confused with Book of Odes (Bible). The Odes of Solomon are a collection of 42 odes attributed to Solomon. There used to be confusion among scholars on the dating of the Odes of Solomon; however, most scholars date it to somewhere between 70-125 AD.[1][2][3] The original language of the Odes is thought to have been either Greek or Syriac, and the majority of scholars believe it to have been written by a Jewish Christia...

Low-volatility investing is an investment style that buys stocks or securities with low volatility and avoids those with high volatility. This investment style exploits the low-volatility anomaly. According to financial theory risk and return should be positively related, however in practice this is not true. Low-volatility investors aim to achieve market-like returns, but with lower risk. This investment style is also referred to as minimum volatility, minimum variance, managed volatility, s...