Taylor, Bean & Whitaker

| |||||||||||||||||||||

Read other articles:

Sedevacantist Catholic organization This article relies excessively on references to primary sources. Please improve this article by adding secondary or tertiary sources. Find sources: Most Holy Family Monastery – news · newspapers · books · scholar · JSTOR (December 2023) (Learn how and when to remove this template message) vaticancatholic.com redirects here. For the location of the Holy See, see Vatican City. Most Holy Family Monastery (also stylized...

Lempeng PasifikJenisMajorPerkiraan luas wilayah103,300,000 km2[1]Pergerakan1Utara-BaratKecepatan156–102 mm (2,2–4,0 in)/tahunWilayahSemenanjung Baja California, California Selatan, Kepulauan Hawaii, Selandia Baru, Kepulauan Solomon archipelago, Alaska Selatan, Samudra Pasifik1Relatif dengan Lempeng Afrika Lempeng Pasifik, ditunjukkan dalam warna kuning muda. Lempeng Pasifik adalah lempeng terbesar dari 7 batas tektonik utama. Dengan ukuran 102.900.000 km2 lebih dari dua ...

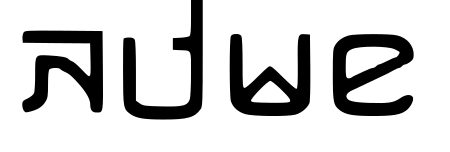

Alphabet used in Myanmar and Thailand Kayah Liꤊꤢꤛꤢ꤭ ꤜꤟꤤ꤬Script type Alphabet Time period1962–presentDirectionLeft-to-right LanguagesKayah languagesISO 15924ISO 15924Kali (357), Kayah LiUnicodeUnicode aliasKayah LiUnicode rangeU+A900–U+A92F This article contains phonetic transcriptions in the International Phonetic Alphabet (IPA). For an introductory guide on IPA symbols, see Help:IPA. For the distinction between [ ], / / a...

Vysšaja Liga 1977высшая лига 1977 Competizione Vysšaja Liga Sport Calcio Edizione 41ª Organizzatore FFSSSR Date dal 1º aprile 1977al 10 novembre 1977 Luogo Unione Sovietica Partecipanti 16 Formula Girone all'italiana Risultati Vincitore Dinamo Kiev(8º titolo) Retrocessioni Karpaty Kryl'ja Sovetov Kujbyšev Statistiche Miglior marcatore Blochin (17) Incontri disputati 240 Gol segnati 486 (2,03 per incontro) Cronologia della competizione ...

Ancient Greek text Hebrew Bible (Judaism) Torah (Instruction)GenesisBereshitExodusShemotLeviticusWayiqraNumbersBemidbarDeuteronomyDevarim Nevi'im (Prophets) Former JoshuaYehoshuaJudgesShofetimSamuelShemuelKingsMelakhim Latter IsaiahYeshayahuJeremiahYirmeyahuEzekielYekhezqel Minor Hosea Joel Amos Obadiah Jonah Micah Nahum Habakkuk Zephaniah Haggai Zechariah Malachi Ketuvim (Writings) Poetic PsalmsTehillimProverbsMishleiJobIyov Five Megillot (Scrolls) Song of SongsShir HashirimRu...

Questa voce sull'argomento centri abitati dell'Alaska è solo un abbozzo. Contribuisci a migliorarla secondo le convenzioni di Wikipedia. TellercomuneTeller – Veduta LocalizzazioneStato Stati Uniti Stato federato Alaska BoroughUnorganized Borough TerritorioCoordinate65°15′26″N 166°21′14″W / 65.257222°N 166.353889°W65.257222; -166.353889 (Teller)Coordinate: 65°15′26″N 166°21′14″W / 65.257222°N 166.353889°W65.257222; -1...

Natural ArchNatural ArchLocation in Andhra Pradesh, IndiaLocationAndhra Pradesh, IndiaNearest townTirupatiCoordinates13°41′14″N 79°20′25″E / 13.68732°N 79.34025°E / 13.68732; 79.34025Width26.2 ft (8.0 m)Elevation9.8 ft (3.0 m) Natural Arch, Tirumala hills, a notified National Geo-heritage Monument,[1][2][3] is a distinctive geological feature 1 km (0.6 mi) north of the Tirumala hills temple, near t...

Town in Brandenburg, GermanyKönigs Wusterhausen TownKönigs Wusterhausen Castle Coat of armsLocation of Königs Wusterhausen within Dahme-Spreewald district Königs Wusterhausen Show map of GermanyKönigs Wusterhausen Show map of BrandenburgCoordinates: 52°17′30″N 13°37′30″E / 52.29167°N 13.62500°E / 52.29167; 13.62500CountryGermanyStateBrandenburgDistrictDahme-Spreewald Subdivisions7 OrtsteileGovernment • Mayor (2021–29) Michaela Wiezor...

内華達州 美國联邦州State of Nevada 州旗州徽綽號:產銀之州、起戰之州地图中高亮部分为内華達州坐标:35°N-42°N, 114°W-120°W国家 美國建州前內華達领地加入聯邦1864年10月31日(第36个加入联邦)首府卡森城最大城市拉斯维加斯政府 • 州长(英语:List of Governors of {{{Name}}}]]) • 副州长(英语:List of lieutenant governors of {{{Name}}}]])喬·隆巴爾多(R斯塔...

Maria ZanoliLahir(1896-10-26)26 Oktober 1896Milan, ItaliaMeninggal15 November 1977(1977-11-15) (umur 81)Milan, ItaliaPekerjaanPemeranTahun aktif1943–1961 Maria Zanoli (26 Oktober 1896 – 15 November 1977) adalah seorang pemeran film Italia. Ia tampil dalam 45 film antara 1943 dan 1961.[1] Sebagian filmografi Loyalty of Love (1934) Incontri di notte (1943) Zazà (1944) Macario contro Zagomar (1944) Circo equestre Za-bum (1944) Giudicatemi! (1948) Il sentiero...

此条目序言章节没有充分总结全文内容要点。 (2019年3月21日)请考虑扩充序言,清晰概述条目所有重點。请在条目的讨论页讨论此问题。 哈萨克斯坦總統哈薩克總統旗現任Қасым-Жомарт Кемелұлы Тоқаев卡瑟姆若马尔特·托卡耶夫自2019年3月20日在任任期7年首任努尔苏丹·纳扎尔巴耶夫设立1990年4月24日(哈薩克蘇維埃社會主義共和國總統) 哈萨克斯坦 哈萨克斯坦政府...

Chaplin: The MusicalThe Story of Charlie ChaplinMusikChristopher CurtisLirikChristopher CurtisNaskahChristopher Curtis Thomas MeehanProduksi2006 New York Musical Theatre Festival 2010 La Jolla Playhouse2012 Broadway 2013 St. Petersburg 2014 Theatro NET SP - Brazil 2016 Henderson, Kentucky Chaplin: The Musical, yang awalnya berjudul Limelight: The Story of Charlie Chaplin, adalah sebuah musikal dengan musik dan lirik buatan Christopher Curtis dan sebuah buku karya Curtis dan Thomas Meehan. Aca...

2009 video game 2009 video gameMisato Katsuragi's Reporting PlanGame coverDeveloper(s)CelliusPublisher(s)Namco BandaiPlatform(s)PlayStation 3, PlayStation PortableReleasePS3, PSPJP: June 6, 2009Genre(s)Casual game, NewsMode(s)Single-player (online play) Misato Katsuragi's Reporting Plan (葛城ミサト報道計画, Katsuragi Misato Hōdō Keikaku) was a Namco Bandai online game for the PlayStation 3. It was based on the anime character Misato Katsuragi from the popular Neon Genesis Evangelio...

This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: List of Yu-Gi-Oh! 5D's characters – news · newspapers · books · scholar · JSTOR (November 2008) (Learn how and when to remove this message) The following is a list of characters from the Yu-Gi-Oh! 5D's anime series. Names refer to the 4K Media English version,...

Automation-focused scripting language for Windows For the use of AutoHotkey by Wikipedia editors, see Wikipedia:AutoHotkey. AutoHotkeyDeveloper(s)Chris Mallett, Steve GrayInitial releaseNovember 10, 2003; 20 years ago (2003-11-10) (Chris Mallet)[1]July 18, 2008; 15 years ago (2008-07-18) (Steve Gray)[2][3]Stable release2.0.17[4] / 5 June 2024; 18 days ago (5 June 2024) Repositorygithub.com/AutoHotkey/AutoHo...

Information technology services company specializing in web hosting Endurance International Group, Inc.Traded asNasdaq: EIGI (2013-2021)IndustryInternet hosting servicesPredecessorBizLandFounded1997 (1997)FoundersHari RavichandranRavi AgarwalHeadquartersJacksonville, Florida, USNumber of locationsWorldwideKey peopleJeff Fox (CEO)Marc Montagner (CFO)David Bryson (CLO)Kim Simone (COO)ServicesWeb hosting, domain registration, SEO, email marketingNumber of employeesOver 2,500 (2016)Pare...

USS Kingman History United States NameKingman NamesakeKingman County, Kansas BuilderMissouri Valley Bridge and Iron Co. Laid down8 January 1945 Launched17 April 1945 Commissioned27 June 1945 Decommissioned15 January 1947 Stricken1 October 1977 IdentificationAPB-47 FateSold for scrapping, 19 November 1980 NotesShip International Radio Callsign: NDBD General characteristics Class and typeBenewah-class barracks ship Displacement4,000 tons Length328 ft (100 m) Beam50 ft (15 m...

BelgiumFlag of BelgiumAssociationBelgian Cricket FederationInternational Cricket CouncilICC statusAssociate member (2005) Affiliate member (1991)ICC regionEuropeICC Rankings Current[1] Best-everWT20I --- 44th (6 Feb 2019)Women's Twenty20 InternationalsFirst WT20Iv. Austria at Seebarn Cricket Ground, Lower Austria; 25 September 2021Last WT20Iv. Luxembourg at Royal Brussels Cricket Club, Waterloo; 20 May 2024WT20Is Played Won/LostTotal[2] 7 0/7(0 ties, 0 no res...

Member of an order of barristers at the English and Irish bar This article is about the English legal office. For the Irish legal office, see Serjeant-at-law (Ireland). Lord Lindley, the last English Serjeant-at-Law A Serjeant-at-Law (SL), commonly known simply as a Serjeant, was a member of an order of barristers at the English and Irish Bar. The position of Serjeant-at-Law (servientes ad legem), or Sergeant-Counter, was centuries old; there are writs dating to 1300 which identify them as de...

1932 1945 Élections législatives de 1936 dans le Tarn 1936 Corps électoral et résultats Inscrits au 1er tour 95 721 Votants au 1er tour 81 907 85,57 % 1 Blancs et nuls au 1er tour 3 068 Inscrits au 2d tour 50 807 Votants au 2d tour 43 836 86,28 % 1,3 Blancs et nuls au 2d tour 1 003 Section française de l'Internationale ouvrière Voix au 1er tour 24 732 31,37 % 11,9 Voix au 2e tour 20 476 4...