Permanent Settlement

|

Read other articles:

SMP Negeri 5 SemarangInformasiDidirikan1 Agustus 1957JenisNegeriAkreditasiA[1]Nomor Pokok Sekolah Nasional20328858Kepala SekolahAloysius Kristiyanto, S.Pd., M.Pd.Rentang kelasVII sampai Kelas IXKurikulumKurikulum MerdekaJumlah siswa864 (32 setiap kelas)AlamatLokasiJl. Sultan Agung No.9, Kota Semarang, Jawa Tengah, IndonesiaTel./Faks.(024) 8315140Koordinat7°00′40″S 110°25′02″E / 7.011030°S 110.417099°E / -7.011030; 110.417099Koordinat: 7°0...

Pipes of Pan beralih ke halaman ini. Untuk kegunaan lain, lihat Pipes of Pan (disambiguasi). siku adalah sebuah pan flute dari Andea Pan flute asal Kepulauan Solomon yang terbuat dari bambu Pan Flute (juga disebut sebagai panpipes atau syrinx) adalah sebuah alat musik yang berdasarkan pada prinsip tabung tertutup, terdiri dari berbagai pipa yang memiliki panjang berbeda.[1] Berbagai ragam pan flute dikenal sebagai alat musik rakyat. Alat musik tersebut biasanya terbuat dari bambu. Bah...

Van Diemen's LandPeta Van Diemen's Land tahun 1852GeografiLokasiSamudra AntartikaKoordinat42°00′S 147°00′E / 42.000°S 147.000°E / -42.000; 147.000Luas68.401 km2Titik tertinggiGunung Ossa (1.614 m)PemerintahanNegaraAustraliaKota terbesarHobart TownKependudukanPenduduk40.000 jiwa (1855)Kelompok etnikAborigin Tasmania Van Diemen's Land adalah nama awal yang diberikan oleh bangsa Eropa untuk pulau Tasmania. Pengelana Belanda Abel Tasman...

Wakil Bupati MamasaPetahanaLowongsejak 19 September 2023Masa jabatan5 tahunDibentuk2003Pejabat pertamaVictor PaotonanSitus webmamasakab.go.id/2020/ Berikut ini adalah daftar Wakil Bupati Mamasa dari masa ke masa. No. Potret Wakil Bupati Mulai menjabat Akhir menjabat Partai Bupati Periode Ref. 1 Victor Paotonan 2003 2008 Muhammad Said Saggaf 1 2 Ramlan Badawi 18 September 2008 27 Juni 2011 PAN Obednego Depparinding 2 [Ket. 1] Jabatan kosong 27 Juni 2011 12 Agustus 2011 Ramlan Bada...

Letak Region Olomouc di Ceko Region Olomouc (bahasa Ceko Olomoucký kraj) merupakan sebuah daerah di Ceko yang memiliki luas wilayah 5.267 km² dan populasi 639.161 jiwa (2006). Ibu kotanya ialah Olomouc. Daftar Kota Nama Populasi Area (km²) Distrik Olomouc 100,523 103 Distrik Olomouc Prostějov 43,680 39 Distrik Prostějov Přerov 43,186 59 Distrik Přerov Šumperk 25,957 28 Distrik Šumperk Hranice 18,057 50 Distrik Přerov Zábřeh 13,589 35 Distrik Šumperk Šternberk 13,495 49 Distrik O...

Koordinat: 7°15′26″S 112°45′19″E / 7.257357°S 112.755240°E / -7.257357; 112.755240 Tambaksari ꦠꦩ꧀ꦧꦏ꧀ꦱꦫꦶ KecamatanPeta lokasi Kecamatan TambaksariNegara IndonesiaProvinsiJawa TimurKotaSurabayaPemerintahan • CamatDrs. Ridwan Mubarun, M.Si.Populasi (2023) • Total215.457 jiwaKode pos60130Kode Kemendagri35.78.10 Kode BPS3578200 Desa/kelurahan8 Tambaksari (Jawa: ꦠꦩ꧀ꦧꦏ꧀ꦱꦫꦶ, translit. Ta...

† Человек прямоходящий Научная классификация Домен:ЭукариотыЦарство:ЖивотныеПодцарство:ЭуметазоиБез ранга:Двусторонне-симметричныеБез ранга:ВторичноротыеТип:ХордовыеПодтип:ПозвоночныеИнфратип:ЧелюстноротыеНадкласс:ЧетвероногиеКлада:АмниотыКлада:Синапсиды�...

† Человек прямоходящий Научная классификация Домен:ЭукариотыЦарство:ЖивотныеПодцарство:ЭуметазоиБез ранга:Двусторонне-симметричныеБез ранга:ВторичноротыеТип:ХордовыеПодтип:ПозвоночныеИнфратип:ЧелюстноротыеНадкласс:ЧетвероногиеКлада:АмниотыКлада:Синапсиды�...

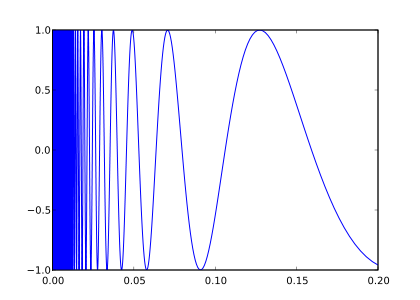

Kurva sinus topologis, contoh berguna dalam topologi point-set. Hal ini terhubung tapi tidak jalan-terhubung.Dalam matematika, topologi umum adalah cabang dari topologi yang berhubungan dengan definisi dan konstruksi teori himpunan dasar yang digunakan dalam topologi. Ini adalah dasar dari sebagian besar cabang lain dari topologi, termasuk topologi diferensial, topologi geometris, dan topologi aljabar. Nama lain untuk topologi umum adalah topologi himpunan-titik. Konsep dasar dalam topologi h...

Azerbaijan AirlinesAzərbaycan Hava Yolları IATA ICAO Kode panggil J2 AHY AZAL Didirikan7 April 1992PenghubungBandara Heydar AliyevKota fokus Ganja Nakhchivan Qabala Program penumpang setiaAZAL MilesAnak perusahaan Buta Airways Azal Avia Cargo Armada23Tujuan40Perusahaan indukPemerintah AzerbaijanKantor pusatBaku, AzerbaijanTokoh utamaJakhangir Askerov (Presiden)Karyawan800Situs webazal.az Azerbaijan Airlines (Azeri: Azərbaycan Hava Yolları) atau dikenal sebagai AZAL adalah maskapai penerba...

American politician: Governor of Georgia (1895–1967)This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages) This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Eurith D. Rivers – news · newspapers · books · scholar ...

American linguist Vitaly Victorovich ShevoroshkinВиталий Викторович ШеворошкинVitaly Viktorovich Shevoroshkin speaking at a conference on October 2004.Born1932Georgia (USSR)NationalityAmericanOccupationLinguist Vitaly Victorovich Shevoroshkin (Russian: Виталий Викторович Шеворошкин) is an American linguist of Russian origin, specializing in the study of ancient Mediterranean languages. Shevoroshkin was born in 1932 in Georgia (USSR).&#...

هنودمعلومات عامةنسبة التسمية الهند التعداد الكليالتعداد قرابة 1.21 مليار[1][2]تعداد الهند عام 2011ق. 1.32 مليار[3]تقديرات عام 2017ق. 30.8 مليون[4]مناطق الوجود المميزةبلد الأصل الهند البلد الهند الهند نيبال 4,000,000[5] الولايات المتحدة 3,982,398[6] الإمار...

Forest and park in Århus, Denmark The Forest of RiisRiis SkovTypical scenery in the beech forest of Riis Skov.GeographyLocationAarhus, Risskov, DenmarkArea0.8 km2 (0.31 sq mi)AdministrationGoverning bodyAarhus MunicipalityEcologyWWF ClassificationBaltic mixed forests Riis Skov (Riis' Forest or The Forest of Riis) is a forest and park in Århus, Denmark. It is located south of the district of Risskov, along the Bay of Aarhus. History The restaurant Sjette Frederiks Kro (18...

Pour les articles homonymes, voir Simone. Nina SimoneBiographieNaissance 21 février 1933TryonDécès 21 avril 2003 (à 70 ans)Carry-le-RouetNom de naissance Eunice Kathleen WaymonPseudonymes Nina Simone, The SongstressÉpoque XXe siècleNationalité américaineFormation Juilliard SchoolAllen School (en)Activités Auteure-compositrice-interprète, artiste d'enregistrement, chanteuse, pianiste de jazz, militante des droits civiquesPériode d'activité 1954-2003Conjoint Andy Stroud (d)Enf...

Cuprian Adamite with calcite, Ojuela Mine, size: 5.6 x 3 x 1.8 cm. Two rhombs of calcite, to 1.75 cm across, colored green with inclusions of aurichalcite. Legrandite from the mine, size: 1.6 x 1.2 x .8 cm. Ojuela was a small mining settlement located northwest of the nearest town Mapimí, 5 kilometres (3.1 mi) northwest. The settlement is now well known as a ghost town as a result of the ore being exhausted. Ojuela was established after the discovery of abandoned gold and silver mines i...

American singer (1913–2007) For the Canadian wrestler, see Frankie Laine (wrestler). Frankie LaineLaine in 1954Background informationBirth nameFrancesco Paolo LoVecchioBorn(1913-03-30)March 30, 1913Chicago, Illinois, U.S.DiedFebruary 6, 2007(2007-02-06) (aged 93)San Diego, California, U.S.GenresTraditional popjazzR&Beasy listeningcountrygospelOccupation(s)Singer, songwriterDiscographyFrankie Laine discographyYears active1932–2007LabelsMercuryPhilipsColumbiaCapitolABCAmosScoreWebs...

Defunct political party in Spain Centrists of Galicia Centristas de GaliciaLeaderVictorino Núñez RodríguezFounded1985 (1985)Dissolved1991 (1991)Split fromGalician CoalitionMerged intoPeople's PartyIdeologyGalician nationalismConservatismPolitical positionCentre-rightPolitics of GaliciaPolitical parties Centrists of Galicia (Spanish: Centristas de Galicia, CdG) was a political party in Galicia, based mainly in the province of Ourense between 1985 and 1991. It emerge...

مجمع اللغة العربية بدمشق مَجْمَع اللُّغَة الْعَرَبِيَّة بِدِمَشْق مجمع اللغة العربية بدمشق البلد سوريا المقر الرئيسي المكتبة العادلية تاريخ التأسيس 1918 المؤسس سعيد بن علي الكرمي، ومتري قندلفت العضوية اتحاد المجامع اللغوية العلمية العربية ال�...

Spanish football team Football clubEspanyol BFull nameReial Club Deportiu Espanyolde Barcelona S.A.D. BNickname(s)Los Periquitos (The Parakeets)Founded1991 as Cristenc-EspañolGroundCiutat Esportiva Dani JarqueCapacity3,000PresidentChen YashengHead coachJavi ChicaLeagueSegunda Federación – Group 32023–24Segunda Federación – Group 3, 9th of 18 Home colours Away colours Third colours Departments of RCD Espanyol Football(Men's) Football(Men's B Team) Football(Women's) Football(Youth Team...