Pensions in Canada

|

Read other articles:

Pemboman TouraneTanggal15 April 1847LokasiLepas Tourane (Đà Nẵng), Pantai Tengah Selatan VietnamHasil Kemenangan A.L. PrancisPihak terlibat Monarki Juli Berkas:Flag of the Nguyen Dynasty (1802-1885).svg Dinasti NguyễnTokoh dan pemimpin Augustin de Lapierre Charles Rigault de Genouilly Berkas:Flag of the Nguyen Dynasty (1802-1885).svg Nguyễn Tri PhươngKekuatan 1 fregat1 korvet 6 korvetKorban tidak ada 1,200 tewas4 korvet tenggelam1 korvet rusak Pemboman Tourane (15 April 1847) merupa...

Cet article est une ébauche concernant le droit français. Vous pouvez partager vos connaissances en l’améliorant (comment ?) selon les recommandations des projets correspondants. Article 90 de la Constitution du 4 octobre 1958 Abrogé Données clés Présentation Pays France Langue(s) officielle(s) Français Type Article de la Constitution Adoption et entrée en vigueur Législature IIIe législature de la Quatrième République française Gouvernement Charles de Gaulle (3e) Promul...

Cet article concerne le peuple khalkha. Pour la langue khalkha, voir Mongol. Si ce bandeau n'est plus pertinent, retirez-le. Cliquez ici pour en savoir plus. Cet article ne cite pas suffisamment ses sources (juillet 2016). Si vous disposez d'ouvrages ou d'articles de référence ou si vous connaissez des sites web de qualité traitant du thème abordé ici, merci de compléter l'article en donnant les références utiles à sa vérifiabilité et en les liant à la section « Notes e...

Minesweeper, sebuah permainan teka-teki komputer populer yang ditemukan di beberapa perangkat. Permainan video teka-teki (Inggris: puzzle video games) meliputi genre unik dari permainan video yang mendorong pemecahan teka-teki. Jenis teka-teki tersebut dapat menguji beberapa keterampilan pemecahan masalah. Pada 2014, permainan teka-teki menjadi genre terbesar dalam iOS App Store.[1] Beberapa contoh permainan video dengan genre teka-teki adalah Lode Runner (1983), Door Door (1983),...

Cet article est une ébauche concernant la mer et le Finistère. Vous pouvez partager vos connaissances en l’améliorant (comment ?) selon les recommandations des projets correspondants. L'entrée du port, protégée par l'île Tristan. Le Port-Rhu est l'ancien port de cabotage de Douarnenez. Occupant l'aber de la « rivière de Pouldavid », il est protégé par l'île Tristan. Étymologie Longtemps connu sous le nom de « rivière de Pouldavid », cette ria est d...

Chilean painter Ximena ArmasSecrets by Ximena Armas.BornXimena Armas Fernández (1946-07-29) 29 July 1946 (age 77)Santiago, ChileNationalityChileanEducation Escuela de Bellas Artes at the Universidad de Chile Escuela de Artes at the Universidad Católica de Chile École nationale supérieure des arts décoratifs in Paris École nationale supérieure des Beaux-Arts in Paris SpouseHenri RicheletPatron(s)Mario Carreño and Mario Toral Websitehttp://ximena.armas.2.free.fr Ximena Armas (born ...

Jurassic ParkEmpire ha classificato la scena dell'incontro con il Brachiosaurus come la 28ª scena più magica mai realizzata in un film[1]Paese di produzioneStati Uniti d'America Anno1993 Durata127 min Rapporto1,85:1 Genereavventura, fantascienza RegiaSteven Spielberg Soggettodal romanzo Jurassic Park di Michael Crichton SceneggiaturaMichael Crichton, David Koepp, Malia Scotch Marmo (non accreditata) ProduttoreKathleen Kennedy, Gerald R. Molen Casa di produzioneUniversal Pictures...

Disambiguazione – Se stai cercando l'antipapa dell'XI secolo, vedi Antipapa Onorio II. Papa Onorio II163º papa della Chiesa cattolicaElezione15 dicembre 1124 Insediamento21 dicembre 1124 Fine pontificato13 febbraio 1130(5 anni e 60 giorni) Cardinali creativedi Concistori di papa Onorio II Predecessorepapa Callisto II Successorepapa Innocenzo II NomeLamberto detto Scannabecchi NascitaFiagnano, 9 febbraio 1060 Consacrazione a vescovo1117 Creazione a cardinale1099 da papa Urb...

Type of Middle Eastern dance Belly dancer redirects here. For other uses, see Belly dancer (disambiguation). This article's lead section may be too short to adequately summarize the key points. Please consider expanding the lead to provide an accessible overview of all important aspects of the article. (October 2023) Belly dancer on a Cairo dinner cruise This article is part of a series onLife in Egypt Culture Architecture Ancient Egyptian art Contemporary Cinema Cuisine Dance Belly dance Raq...

American baseball player (born 1986) Baseball player Daniel SchlerethSchlereth pitching for the Detroit Tigers in 2011PitcherBorn: (1986-05-09) May 9, 1986 (age 38)Anchorage, Alaska, U.S.Batted: LeftThrew: LeftMLB debutMay 29, 2009, for the Arizona DiamondbacksLast MLB appearanceApril 21, 2012, for the Detroit TigersMLB statisticsWin–loss record5–6Earned run average4.35Strikeouts91 Teams Arizona Diamondbacks (2009) Detroit Tigers (2010–2012) Daniel Rob...

The Luangwa basin with the Lunsemfwa (bottom left) The Lunsemfwa River is a tributary of the Luangwa Rivers in Zambia and part of the Zambezi River basin. It is a popular river for fishing, containing large populations of tigerfish and bream.[citation needed] It rises on the south-central African plateau at an elevation of about 1250 m to the north of Mkushi and south of the border of Congo Pedicle, and flows south. It is used to generate hydroelectric power for the Kabwe mines throug...

Place in Maharashtra, IndiaKhopoliCityMumbai Metropolitan RegionNickname: City Of WaterfallsKhopoliLocation in Maharashtra, IndiaCoordinates: 18°47′20″N 73°20′35″E / 18.789°N 73.343°E / 18.789; 73.343CountryIndiaStateMaharashtraDistrictRaigadElevation61 m (200 ft)Population (2011) • Total108,648DemonymKhopolikarLanguage • OfficialMarathiTime zoneUTC+5:30 (IST)PIN410203 410204 410216Vehicle registrationMH-46 Khopo...

2017 South Korean television series Some of this article's listed sources may not be reliable. Please help improve this article by looking for better, more reliable sources. Unreliable citations may be challenged and removed. (May 2018) (Learn how and when to remove this message) My Father Is StrangePromotional posterHangul아버지가 이상해 GenreFamilyDramaRomanceComedyCreated byKBS Drama Production (KBS 드라마 제작국)Written byLee Jung SunDirected byLee Jae-sangCreative directorsJ...

Навчально-науковий інститут інноваційних освітніх технологій Західноукраїнського національного університету Герб навчально-наукового інституту інноваційних освітніх технологій ЗУНУ Скорочена назва ННІІОТ ЗУНУ Основні дані Засновано 2013 Заклад Західноукраїнський �...

Private school in Bronx, New York, United StatesMount Saint Michael AcademyAddress4300 Murdock Avenue(Wakefield), Bronx, New York 10466United StatesCoordinates40°53′55″N 73°50′32″W / 40.89861°N 73.84222°W / 40.89861; -73.84222InformationTypePrivateMottoAd Astra Per Aspera(To the Stars Through Difficulties)Religious affiliation(s)Roman Catholic (Marist Brothers)Established1926 (98 years ago) (1926)[2]PresidentPeter P. Corritori, Jr. ...

Disambiguazione – Se stai cercando altri significati, vedi Pisa (disambigua). Questa voce o sezione sull'argomento Toscana è priva o carente di note e riferimenti bibliografici puntuali. Sebbene vi siano una bibliografia e/o dei collegamenti esterni, manca la contestualizzazione delle fonti con note a piè di pagina o altri riferimenti precisi che indichino puntualmente la provenienza delle informazioni. Puoi migliorare questa voce citando le fonti più precisamente. Segui i suggerim...

淨土真宗本願寺派(じょうどしんしゅうほんがんじは)是淨土真宗之一派。 概要 本山是宗祖親鸞的墓所「大谷廟堂」發祥的「本願寺」(「西本願寺」)。淨土真宗(真宗)最大宗派。 1592年淨土真宗第十一代法主顯如去世後發生繼承權紛爭,其子教如與准如爭立。豐臣秀吉立准如為法主。1602年教如得到德川家康的捐助而創派,脫離准如,另建新教團,是為東本願寺派,...

Association football club in England For the women's football club, see West Bromwich Albion F.C. Women. The Baggies redirects here. For other uses, see Baggies (disambiguation). Football clubWest Bromwich AlbionFull nameWest Bromwich Albion Football ClubNickname(s) The Baggies The Throstles The Albion Short name WBA West Brom Albion Founded1878; 146 years ago (1878)GroundThe HawthornsCapacity26,852[1]OwnerBilkul Football WBAChairmanShilen PatelManagerCarlos Corberá...

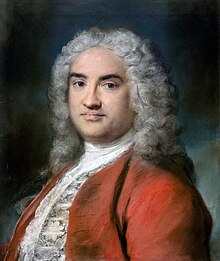

Elector of Brandenburg from 1640 to 1688 For the electors of Brandenburg who were also kings of Prussia, see Frederick William. Frederick WilliamPortrait by Frans Luycx, c. 1650Elector of BrandenburgDuke of PrussiaReign1 December 1640 – 29 April 1688PredecessorGeorge WilliamSuccessorFrederick IIIBorn(1620-02-16)16 February 1620Stadtschloss, Berlin, Brandenburg-Prussia, Holy Roman EmpireDied29 April 1688(1688-04-29) (aged 68)Stadtschloss, Potsdam, Brandenburg-Prussia, Holy Roman EmpireB...

Economist and writer (1728–1797) Pietro VerriVerri c. 1740Born(1728-12-12)12 December 1728Milan, Duchy of MilanDied28 June 1797(1797-06-28) (aged 68)Milan, Transpadane RepublicNationalityItalianSpouse(s)Marietta Castiglioni, Vincenza Melzi d'ErilChildrenTeresa, Alessandro (from Marietta Castiglioni)Parent(s)Gabriele Verri, BarbaraAcademic backgroundInfluences Montesquieu Voltaire Rousseau Hume Gibbon Helvétius[1] Galileo Newton[2] Beccaria Academic workEra18th centuryD...