Long/short equity

|

Read other articles:

لمعانٍ أخرى، طالع مير أباد (توضيح). مير أباد تقسيم إداري البلد إيران إحداثيات 32°51′48″N 51°02′46″E / 32.8633°N 51.0461°E / 32.8633; 51.0461 تعديل مصدري - تعديل مير أباد هي قرية في مقاطعة تيران وكرون، إيران. عدد سكان هذه القرية هو 3,500 في سنة 2006.[1] مراجع ^ تعداد سكان...

American judge (1843–1913) This article relies largely or entirely on a single source. Relevant discussion may be found on the talk page. Please help improve this article by introducing citations to additional sources.Find sources: Joseph Cross judge – news · newspapers · books · scholar · JSTOR (August 2022) Joseph CrossJudge of the United States District Court for the District of New JerseyIn officeMarch 17, 1905 – October 29, 1913A...

Westland Wessex adalah helikopter versi bertenaga turbin Inggris dari Sikorsky S-58 Choctaw, dikembangkan di bawah lisensi oleh Westland Aircraft (kemudian Westland Helicopters), awalnya untuk Royal Navy, dan kemudian untuk Royal Air Force (RAF). Wessex dioperasikan sebagai anti-kapal selam dan helikopter serba guna utilitas dalam beberapa negara, mungkin yang paling terkenal di Inggris untuk layanan sebagai pencarian dan penyelamatan (SAR) helikopter. Jenis pertama memasuki layanan pada tah...

الدوري الإيطالي الدرجة الأولى تفاصيل الموسم 2015–2016 النسخة 114 البلد إيطاليا التاريخ بداية:22 أغسطس 2015 نهاية:15 مايو 2016 المنظم رابطة الدوري الإيطالي للمحترفين البطل يوفنتوس اللقب الثاني والثلاثين الهابطون كاربيفروسينونيهيلاس فيرونا دوري أبطال أوروبا يوفنتو...

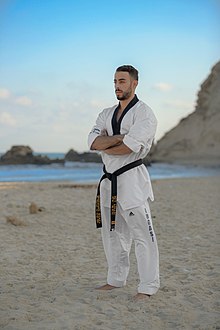

Israeli taekwondo practitioner Moti Lugasi Medal record Representing Israel Men’s taekwondo 2010 European Taekwondo Championships 2010 Saint Petersburg 54 kg Moti lugasi pro atlete. Moti Lugasi (born April 18, 1992) is an Israeli taekwondo athlete. He won a bronze medal at the age of 18 in the 54 kg (fin) class at the 2010 European Taekwondo Championships.[1][2][3][4] References ^ Taekwondo - Moti Lugasi (Israel): season totals. The-sports.org. Ret...

American politician For other people named William Cohen, see William Cohen (disambiguation). William W. CohenMember of the U.S. House of Representativesfrom New York's 17th districtIn officeMarch 4, 1927 – March 3, 1929Preceded byOgden L. MillsSucceeded byRuth Baker Pratt Personal detailsBorn(1874-09-06)September 6, 1874Brooklyn, New York City, New York, U.S.DiedOctober 12, 1940(1940-10-12) (aged 66)New York City, New York, U.S.Political partyDemocraticSpouseSophi...

2009 European Parliament election in the Czech Republic ← 2004 5–6 June 2009 2014 → 22 seats in the European ParliamentTurnout28.22% First party Second party Leader Jan Zahradil Jiří Havel Party ODS ČSSD Alliance AECR PES Seats won 9 7 Seat change 5 Popular vote 741,946 528,132 Percentage 31.45% 22.39% Swing 1.40pp 13.61pp Third party Fourth party Leader Miloslav Ransdorf Zuzana Roithová Party KSČM KDU-ČSL Alliance GUE/...

2006 video game 2006 video gameCooking MamaNintendo DS cover artDeveloper(s)Office CreatePublisher(s)JP: TaitoNA: Majesco EntertainmentPAL: 505 GamesComposer(s)Masayoshi IshiSeriesCooking MamaPlatform(s)Nintendo DS, iOSReleaseNintendo DSJP: March 23, 2006NA: September 12, 2006AU: December 7, 2006EU: December 8, 2006 iOS WW: February 26, 2009Genre(s)Simulation, minigameMode(s)Single-player, multiplayer Cooking Mama[a] is a cookery simulation-styled minigame compilation video game for t...

Christoffel van Swoll Gubernur Jenderal Hindia Belanda ke-19Masa jabatan17 November 1713 – 12 November 1718PendahuluAbraham van RiebeeckPenggantiHendrick Zwaardecroon Informasi pribadiLahir(1668-04-25)25 April 1668Amsterdam, Republik BelandaMeninggal12 November 1718(1718-11-12) (umur 50)Batavia, Hindia Belanda (sekarang Indonesia)Sunting kotak info • L • B Christoffel van Swoll (25 April 1668 – 12 November 1718), adalah Gubernur-Jenderal Hindia Be...

SUGP2 التراكيب المتوفرة بنك بيانات البروتينOrtholog search: PDBe RCSB قائمة رموز معرفات بنك بيانات البروتين 1X4P المعرفات الأسماء المستعارة SUGP2, SFRS14, SURP and G-patch domain containing 2, SRFS14 معرفات خارجية الوراثة المندلية البشرية عبر الإنترنت 607993 MGI: MGI:2678085 HomoloGene: 8923 GeneCards: 10147 علم الوجود الجيني الوظيفة ال...

Флаг гордости бисексуалов Бисексуальность Сексуальные ориентации Бисексуальность Пансексуальность Полисексуальность Моносексуальность Сексуальные идентичности Би-любопытство Гетерогибкость и гомогибкость Сексуальная текучесть Исследования Шк...

West Chester UniversityJenisKoedukasional negeriDidirikan1871Dana abadi$23 juta pada 2015.[1]PresidenChristopher FiorentinoProvosR. Lorraine BernotskyStaf akademik685 waktu penuh; 277 paruh waktuJumlah mahasiswa16,426[1]Sarjana14,148[1]Magister2,278[1]LokasiWest Chester, Pennsylvania, AS39°57′08″N 75°36′00″W / 39.95219°N 75.60010°W / 39.95219; -75.60010Koordinat: 39°57′08″N 75°36′00″W / 39.95219°N 7...

Artikel ini perlu diwikifikasi agar memenuhi standar kualitas Wikipedia. Anda dapat memberikan bantuan berupa penambahan pranala dalam, atau dengan merapikan tata letak dari artikel ini. Untuk keterangan lebih lanjut, klik [tampil] di bagian kanan. Mengganti markah HTML dengan markah wiki bila dimungkinkan. Tambahkan pranala wiki. Bila dirasa perlu, buatlah pautan ke artikel wiki lainnya dengan cara menambahkan [[ dan ]] pada kata yang bersangkutan (lihat WP:LINK untuk keterangan lebih lanjut...

American college basketball season 1992–93 Notre Dame Fighting Irish men's basketballConferenceIndependentRecord9–18Head coachJohn MacLeod (2nd season)Home arenaJoyce CenterSeasons← 1991–921993–94 → 1992–93 NCAA Division I men's basketball independents standings vte Conf Overall Team W L PCT W L PCT UW-Milwaukee - – - – 23 – 4 .852 UMKC - – - – 15 – 12 .556 Souther...

Swedish poet, intellectual and spiritual figure Kurt AlmqvistTage Lindbom (left) with Kurt Almqvist (right)Born(1912-03-11)11 March 1912Falun, SwedenDied8 April 2001(2001-04-08) (aged 89) Kurt Almqvist (1912–2001) was a Swedish poet, intellectual and spiritual figure, representative of the Traditionalist School and the Perennial philosophy.[1][2][3] Almqvist was a lifelong disciple of the Swiss metaphysician and spiritual guide Frithjof Schuon. He came into clos...

Thai League 1Sport Calcio TipoClub FederazioneFAT Paese Thailandia OrganizzatoreFederazione calcistica della Thailandia TitoloCampione di Thailandia CadenzaAnnuale Aperturaluglio Chiusuramaggio Partecipanti16 Retrocessione inThai League 2 Sito Internetwww.thaipremierleague.co.th/ StoriaFondazione1916 Detentore Buriram Utd Record vittorie Buriram Utd (10) Ultima edizioneThai League 2023-2024 Modifica dati su Wikidata · Manuale La Thai League 1 (in thailandese ทย�...

Multi-purpose stadium in Minneapolis, Minnesota, U.S. U.S. Bank StadiumThe ShipU.S. Bank Stadium in September 2021, with the skyline of Minneapolis reflected in the stadium windows.U.S. Bank StadiumLocation in MinnesotaShow map of MinnesotaU.S. Bank StadiumLocation in the United StatesShow map of the United StatesU.S. Bank StadiumU.S. Bank Stadium (North America)Show map of North AmericaFull nameUS Bank StadiumAddress401 Chicago AvenueLocationMinneapolis, Minnesota, U.S.Coordinates44°58′26...

German karateka (born 1989) Noah BitschNoah Bitsch in 2018Personal informationBorn (1989-09-29) 29 September 1989 (age 34)SportCountryGermanySportKarate Medal record Men's karate Representing Germany World Championships 2014 Bremen Team kumite 2014 Bremen 75 kg 2016 Linz Team kumite European Championships 2012 Adeje Team kumite 2015 Istanbul 75 kg 2012 Adeje 75 kg 2013 Budapest Team kumite 2014 Tampere Team kumite 2016 Montpellier 84 kg 2021 Poreč 75 kg World Games 2013 Cali 75 kg...

ソーニコSonico 行政国 イタリア州 ロンバルディア県/大都市 ブレシアCAP(郵便番号) 25050市外局番 0364ISTATコード 017181識別コード I831分離集落 #分離集落参照隣接コムーネ #隣接コムーネ参照気候分類 zona F, 3120 GG公式サイト リンク人口人口 1,222 [1] 人 (2021-01-01)人口密度 20.3 人/km2文化住民の呼称 sonicesi守護聖人 聖ロレンツォ(san Lorenzo)祝祭日 8月10日地理座標 北緯46度...

Kate & LeopoldMeg Ryan e Hugh Jackman in una scena del filmTitolo originaleKate & Leopold Paese di produzioneStati Uniti d'America Anno2001 Durata118 min (versione cinematografica)123 min (Director's Cut) Generecommedia, sentimentale, fantastico RegiaJames Mangold SoggettoSteven Rogers SceneggiaturaJames Mangold, Steven Rogers ProduttoreKathy Conrad Produttore esecutivoBob Weinstein, Harvey Weinstein, Meryl Poster, Kerry Orent Casa di produzioneMiramax Films FotografiaStuart D...