Financial sector development

|

Read other articles:

Possible Greco-Persian treaty (c. 449 BC) The Peace of Callias is a purported peace treaty that supposedly was established around 449 BC between the Delian League (led by Athens) and the Achaemenid Empire and ended the Greco-Persian Wars. The peace would then be the first compromise treaty between Achaemenid Persia and a Greek city. The peace was negotiated by Callias, an Athenian politician. Persia had continually lost territory to the Greeks after the end of Xerxes I's invasion in 479 BC. T...

Peta infrastruktur dan tata guna lahan di Komune Guigneville-sur-Essonne. = Kawasan perkotaan = Lahan subur = Padang rumput = Lahan pertanaman campuran = Hutan = Vegetasi perdu = Lahan basah = Anak sungaiGuigneville-sur-EssonneNegaraPrancisArondisemenÉtampesKantonLa Ferté-AlaisAntarkomunebelum ada pada 2007Kode INSEE/pos91293 / Guigneville-sur-Essonne merupakan sebuah komune di département Essonne, di region Île-de-France di Prancis. D...

Polynesian island country This article is about the nation of Samoa. For the geographical region, see Samoan Islands. For the Samoan United States territory, see American Samoa. For other uses, see Samoa (disambiguation). Independent State of SamoaMalo Saʻoloto Tutoʻatasi o Sāmoa (Samoan) Flag Coat of arms Motto: Faʻavae i le Atua SāmoaSamoa is founded on GodAnthem: O Le Fuʻa o le Saʻolotoga o SamoaThe Banner of FreedomLocation of SamoaMap of SamoaCapitaland largest city...

Room on the White House's second floor This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: Lincoln Sitting Room – news · newspapers · books · scholar · JSTOR (August 2009) (Learn how and when to remove this template message) Floor plan of the White House second floor showing location of the Lincoln Sitting Room....

Motown Données clés Filiale Motown est une filiale de Universal Music Group Fondation 12 novembre 1959 Fondateur Berry Gordy Statut Actif Distributeur Capitol Music Group (États-Unis), Motown UK/EMI (États-Unis), Island Def Jam (France), UMe (rééditions) Genre Soul, pop, jazz, rhythm and blues Pays d'origine États-Unis Siège Los Angeles, Californie Site web www.motownrecords.com modifier Motown, ou Motown Records, est un label discographique américain, qui fait partie de Universal M...

7th season of the Premier League This article includes a list of general references, but it lacks sufficient corresponding inline citations. Please help to improve this article by introducing more precise citations. (September 2012) (Learn how and when to remove this template message) Football league seasonFA Premier LeagueSeason1998–99Dates15 August 1998 – 16 May 1999ChampionsManchester United5th Premier League title12th English titleRelegatedCharlton AthleticBlackburn RoversNottingham F...

Birmingham Edgbastoncollegio elettoraleBirmingham Edgbaston a Birmingham Stato Regno Unito CapoluogoBirmingham Elezioni perCamera dei comuni Eletti1 deputato (Preet Gill, Lab Co-Op, dal 2017) Tipologiauninominale Istituzione1885 Creato daBirmingham Manuale Birmingham Edgbaston è un collegio elettorale situato a Birmingham, nelle Midlands Occidentali, e rappresentato alla Camera dei comuni del Parlamento del Regno Unito. Elegge un membro del parlamento con il sistema first-past-the-...

У этого термина существуют и другие значения, см. Чайки (значения). Чайки Доминиканская чайкаЗападная чайкаКалифорнийская чайкаМорская чайка Научная классификация Домен:ЭукариотыЦарство:ЖивотныеПодцарство:ЭуметазоиБез ранга:Двусторонне-симметричныеБез ранга:Вторич...

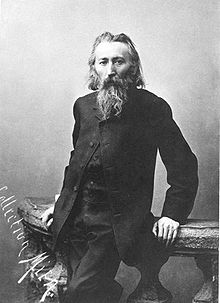

Jan MatejkoLahirJan Mateyko24 Juni 1838Kota Merdeka KrakówMeninggal1 November 1893(1893-11-01) (umur 55)Kraków, Polandia AustriaMakamPemakaman RakowickiKebangsaanPolandiaPendidikanSekolah Seni Rupa KrakówAkademi Seni Rupa MünchenDikenal atasSeni lukisKarya terkenalBattle of GrunwaldStańczykThe Prussian HomageThe Hanging of the Sigismund bellGerakan politikLukisan sejarahSuami/istriTeodora Matejko Jan Alojzy Matejko (pengucapan bahasa Polandia: [jan aˈlɔjzɨ maˈtɛjko]; juga...

此条目序言章节没有充分总结全文内容要点。 (2019年3月21日)请考虑扩充序言,清晰概述条目所有重點。请在条目的讨论页讨论此问题。 哈萨克斯坦總統哈薩克總統旗現任Қасым-Жомарт Кемелұлы Тоқаев卡瑟姆若马尔特·托卡耶夫自2019年3月20日在任任期7年首任努尔苏丹·纳扎尔巴耶夫设立1990年4月24日(哈薩克蘇維埃社會主義共和國總統) 哈萨克斯坦 哈萨克斯坦政府...

Town in New Hampshire, United StatesNottingham, New HampshireTownRoad junction in the village of Nottingham SealLocation in Rockingham County and the state of New HampshireCoordinates: 43°06′52″N 71°05′59″W / 43.11444°N 71.09972°W / 43.11444; -71.09972CountryUnited StatesStateNew HampshireCountyRockinghamIncorporated1722VillagesNottinghamNottingham SquareNorth NottinghamWest NottinghamGovernment • Board of SelectmenBenjamin Bartlett, ChairJohn ...

Film industry of Taiwan Cinema of TaiwanMingshen TheaterNo. of screens384 (2017)[1]Gross box office (2017)[2]Total$106 millionNational films$7.29 million (6.90%) The cinema of Taiwan or Taiwan cinema (Chinese: 臺灣電影 or 台灣電影) is deeply rooted in the island's unique history. Since its introduction to Taiwan in 1901 under Japanese rule, cinema has developed in Taiwan under ROC rule through several distinct stages, including taiyu pian (Taiwanese ...

American economist (born 1930) Thomas SowellSowell in 1964Born (1930-06-30) June 30, 1930 (age 93)Gastonia, North Carolina, U.S.EducationHarvard University (BA)Columbia University (MA)University of Chicago (PhD)Political partyDemocratic (until 1972)Independent (after 1972)Spouses Alma Parr (m. 1964; div. 1975) Mary Ash (m. 1981) Children2Academic careerInstitutions U.S. Department of Labor (1961–1962) Ru...

Disambiguazione – Pacelli rimanda qui. Se stai cercando altri significati, vedi Pacelli (disambigua). Disambiguazione – Pio XII rimanda qui. Se stai cercando altri significati, vedi Pio XII (disambigua). Papa Pio XIIMichael Pitcairn, ritratto fotografico di Pio XII (1951 ca.)260º papa della Chiesa cattolica Elezione2 marzo 1939 Incoronazione12 marzo 1939 Fine pontificato9 ottobre 1958(19 anni e 221 giorni) MottoOpus iustitiae pax Cardinali creativedi Concistori...

This article is about a temple. For a municipality, see Swargadwari Municipality. Hindu temple in Rapti Zone, Nepal Sworgadwari / Swargadwariस्वर्गद्वारीReligionAffiliationHinduismDistrictPyuthan DistrictDeityLord Narayan or Bishnu, Lord ShivaFestivalsBaisakh, Kartik PurnimaLocationLocationMahabharat RangeStateRapti ZoneCountryNepalShown within NepalGeographic coordinates28°7′16.68″N 82°40′24.55″E / 28.1213000°N 82.6734861°E / 28.121...

يفتقر محتوى هذه المقالة إلى الاستشهاد بمصادر. فضلاً، ساهم في تطوير هذه المقالة من خلال إضافة مصادر موثوق بها. أي معلومات غير موثقة يمكن التشكيك بها وإزالتها. (مايو 2023) فلورين مارين معلومات شخصية الميلاد 19 مايو 1953 (71 سنة) بوخارست الطول 1.87 م (6 قدم 2 بوصة) مركز اللع�...

Vampire in BrooklynPoster filmSutradaraWes CravenProduserEddie MurphyMark LipskySkenarioCharles MurphyMichael LuckerChris ParkerCeritaEddie MurphyVernon LynchCharles MurphyPemeranEddie MurphyAngela BassettAllen PayneKadeem HardisonJohn WitherspoonZakes MokaeJoanna CassidyPenata musikJ. Peter RobinsonSinematograferMark IrwinPenyuntingPatrick LussierDistributorParamount PicturesTanggal rilis27 Oktober 1995Durasi102 menitNegara Amerika SerikatBahasaInggrisAnggaranAS$14.000.000Pendapat...

بوفيكساماك الاسم النظامي 2-(4-butoxyphenyl)-N-hydroxyacetamide اعتبارات علاجية ASHPDrugs.com أسماء الدواء الدولية طرق إعطاء الدواء Topical, rectal بيانات دوائية إخراج (فسلجة) Renal معرّفات CAS 2438-72-4 ك ع ت M01M01AB17 AB17 M02AA09 (منظمة الصحة العالمية) بوب كيم CID 2466 IUPHAR 7498 ECHA InfoCard ID 100.017.683 درغ بنك DB13346 كيم سباي�...

This article relies largely or entirely on a single source. Relevant discussion may be found on the talk page. Please help improve this article by introducing citations to additional sources.Find sources: Eddie Presley – news · newspapers · books · scholar · JSTOR (June 2017) 1992 American filmEddie PresleyDVD coverDirected byJeff BurrWritten byDuane WhitakerBased onEddie Presley (play)by Duane WhitakerStarringDuane WhitakerLawrence TierneyRelease date...

Options and futures exchange in Chicago Chicago Board of TradeTypeSubsidiaryFoundedApril 3, 1848OwnerCME Group41°52′40″N 87°37′56″W / 41.877821°N 87.632285°W / 41.877821; -87.632285The Chicago Board of Trade (CBOT), established on April 3, 1848, is one of the world's oldest futures and options exchanges.[1] On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other exchanges (CME, NYMEX, and ...